The textile industry is the largest industry of modern India. The industry accounts for 14 per cent of the total industrial production, contributes to nearly 30 per cent of the total exports and is the second largest employment generator after agriculture. Our economy is largely dependent on the textile manufacturing and trade in addition to other major industries. About 27 per cent of the foreign exchange earnings are on account of export of textiles and clothing alone. Around 8 per cent of the total excise revenue collection is contributed by the textile industry. So much so, the textile industry accounts for as large as 21 per cent of the total employment generated in the economy. Around 35 mn people are directly employed in the textile manufacturing activities. Indirect employment including the manpower engaged in agricultural based raw-material production like cotton and related trade and handling could be stated to be around another 60 mn.

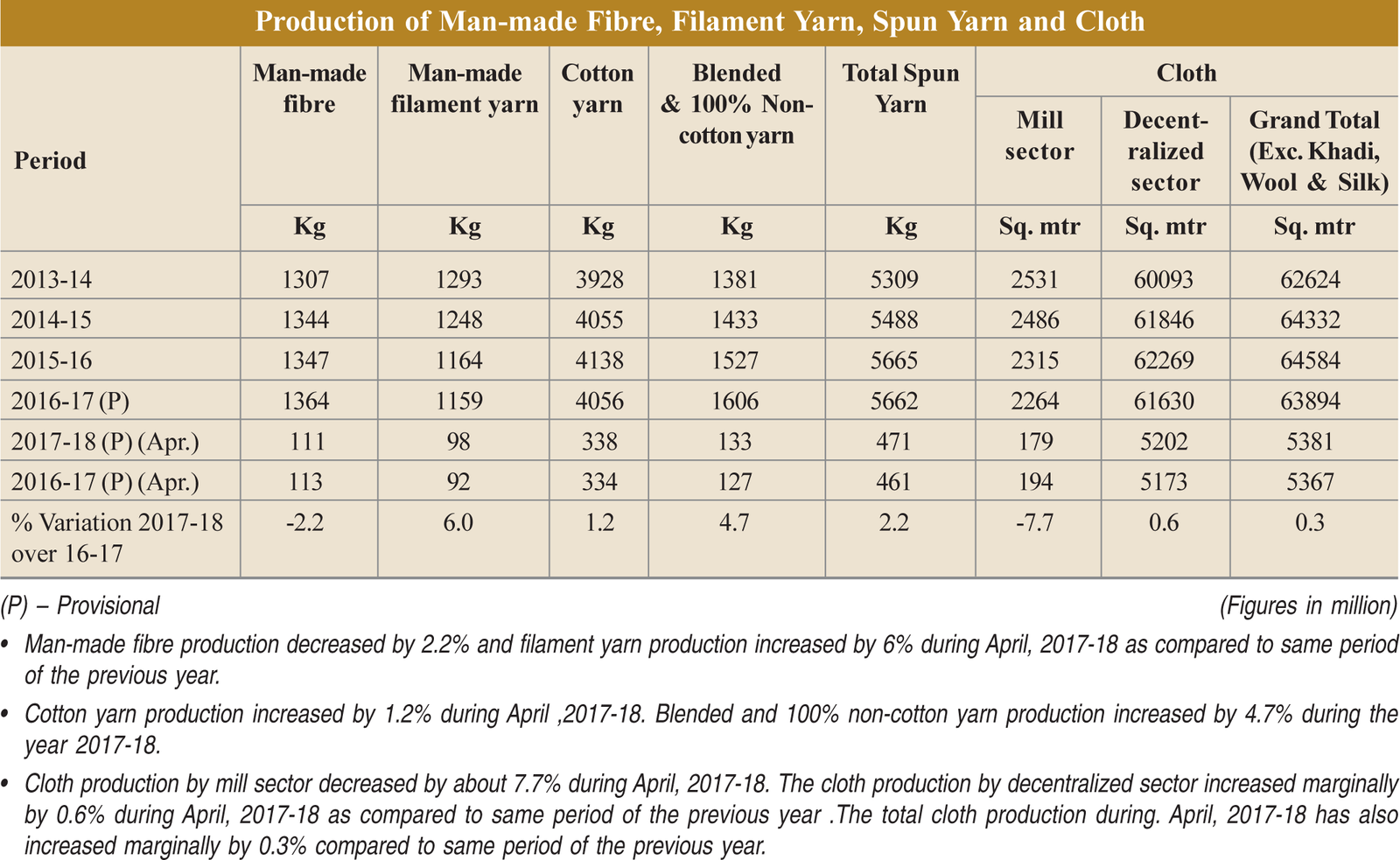

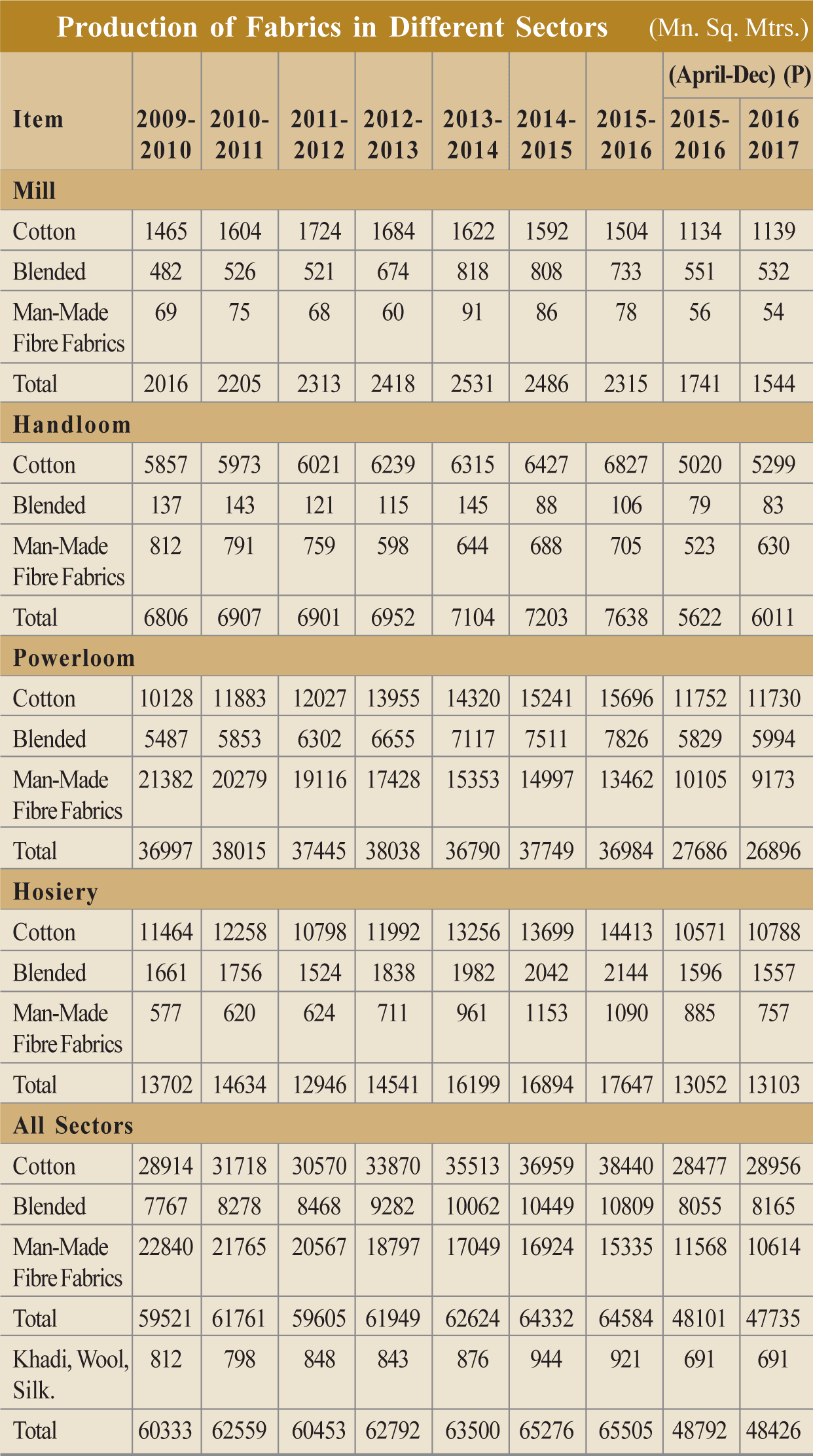

The structure of the textile industry is extremely complex with the modern, sophisticated and highly mechanized mill sector on the one hand and the handspinning and handweaving (handloom) sector on the other. Between the two falls the small-scale powerloom sector. Over the years, the government has granted a whole range of concessions to the non-mill sector as a result of which the share of the decentralised sector has increased considerably in the total production. Of the two sub-sectors of the decentralised sector, the powerloom sector has shown the faster rate of growth. In the production of fabrics the decentralised sector accounts for roughly 94 per cent while the mill sector has a share of only 6 per cent.

Fabric industry dimensions

The Indian fabric industry is currently estimated at a whopping figure of $108 bn and is likely to reach around $223 bn by 2021. The industry is one of the highest yielding industries of the nation and contributes approximately 5 per cent to India’s Gross Domestic Product (GDP). A recent study shows that the Indian fabric industry has the potential to surpass the $500 bn mark. Textile is also India’s dominant export good and the country has been exporting fabric and other industry related goods since ages. The current textile exports of the country stood at $40 bn. The Indian textile industry has the capacity to produce a wide variety of products suitable to different market segments, both within India and across the world. The study also forecasts a humongous rise in domestic sales to $315 bn. from currently $68 bn. and a rapid increase in the exports to $185 bn. from currently $41 bn. in the upcoming few years.

Even at a glance India’s textile future looks quite secure as Asian peninsula is among leading producers of the major fibres in the world. India’s fabric industry revolves around cotton as India is the second largest cotton producer in the world and 60 per cent of industry is also cotton based. India exports cotton fabrics majorly to Japan, United States, United Kingdom, Russia, France, Nepal, Singapore, Sri Lanka and other countries. Even though India has largest share in the world trade of cotton yarn but its trade in garments is only 4 per cent of the world’s total.

Current status ofspinning industry

Spinning mills that were facing a problem during the first half of FY17 due to rising prices of cotton are soon set to see a U-turn in their fortunes. In the last two months, news of good monsoon, higher acreage under cotton cultivation and better output expected for the 2017-18 season are harbingers of stable, if not higher profitability.

From April to November 2016, cotton prices (Sankar-6 variety) soared from `90 per kg to around `140 per kg. Lower crop and tight inventory levels fuelled prices in the domestic market. Meanwhile, news of China’s lower stock inventory led to hope that China’s cotton imports will resume again. This too supported the high cotton prices. Spinning mills therefore bore the brunt of the high prices impacting operating margins during the last two quarters.

Profitability was squeezed, as a result, of the twin problems of flat revenue growth and high input costs. The average operating margin after peaking at 15.4 per cent in the September 2016 quarter, dropped to 12.8 per cent in the December quarter and further to 11 per cent in the March 2017 quarter.

But softer cotton prices in the last two months bring hope for mills. Will it sustain? Industry experts forecast a 10 per cent increase in acreage in the 2017-18 season after a similar decline in the previous season. Also, international prices are unlikely to firm up given the robust harvest in United States of America and also Australia. Domestic prices being linked to global indicators, they should therefore stay soft in the coming months.

The key, however, is for yarn demand to increase. India’s total yarn production declined to a five-year low in FY2017. The demand from mills was weak during 2016 primarily due to a steep decline in cotton yarn exports (due to weak Chinese imports), which comprises a third of the country’s output. Although exports have revived in the last few months, analysts believe that it is insufficient to offset the steep decline earlier.

Mills are also hopeful of higher off take by domestic fabric weavers given the festive season ahead and the pent-up demand following a near freeze in off take due to demonetisation and the uncertainty linked to the new goods and services tax (GST). Meanwhile, there is not much hope for mills in terms of realization on sales as yarn prices are expected to be range bound given moderate utilization levels and soft input (cotton) prices. ICRA forecasts profitability of spinners to remain range-bound at a modest level sustained during the past three years.

Meanwhile, although the 5 per cent GST is a welcome step for the cotton textile industry, issues and costs related to compliance may lead to disruption in the supply chain for some more quarters, given the small and medium scale nature of spinners and weavers. A true picture on operating performance would be seen only from the second half of FY2018.

Government Policies

Many initiatives were announced in the Union Budget 2017-18. The Central Govt. has adopted a number of export promotion policies for the textile sector. It has also allowed 100 per cent FDI in the sector under the automatic route. Govt. is also focusing on upgrading labour skills by allocating $330 mn.

The Government of India plans to introduce a mega package for the power loom sector, which will include social welfare schemes, insurance cover, cluster development, and upgradation of obsolete looms, along with tax benefits and marketing support, which is expected to improve the status of power loom weavers in the country. Govt. is also encouraging new entrepreneurs to invest in sectors such as knitwear by increasing allocation of funds to Mudra Bank from $20.4 bn. to $36.6 bn.The government of India has implemented several export promotion measures such as:

Specified technical textile products are covered under Focus Product Scheme. Under this scheme, exports of these products are entitled for duty credit scrip equivalent to 2 per cent of freight on board (FOB) value of exports

Under the Market Access Initiative (MAI) Scheme, financial assistance is provided for export promotion activities on focus countries and focus product countries

Under the Market Development Assistance (MDA) Scheme, financial assistance is provided for a range of export promotion activities implemented by textiles export promotion councils.

Meanwhile, the recent govt.’s decision of implementation of GST overall looks good for textiles in long run subject to restriction on movement of goods and refund process work smoothly. In case of exports it will have negative impact in terms of reduction in duty drawback rates, ROSL scheme announced on the same rates for 3 months but no more a support providing model, Merchandise Exports from India Scheme is continue but restriction to use it only in basic customs duty have reduced the value by 20 per cent. In case of apparel exports competition is global and export will have impact due to reduction in incentives. Further there will be more requirement of working capital now. Further putting job work under tax net and carrying rate of 18 per cent will be undue hardship. Now even job wok of cotton will attract 18 per cent GST if it is a related process of apparel. Example, garment sewing will now falls under 18 per cent GST. Government should look into incentives to keep Indian apparel industry globally competitive.

Future outlook

The domestic market for apparel and lifestyle products, currently estimated at $85 bn, is expected to reach $160 bn by 2025. This growth will be driven by the rising middle class. The government’s industry-friendly initiatives like repealing of 1,200 “outdated laws” and carrying out 7,000 reforms have resulted in India becoming a preferred investment destination.

Major growth drivers for India’s textile & clothing industry

- Higher focus from Govt. of India on “manufacturing” sector, with textiles being one of the big focus sectors

- A relatively complete and robust fibre – finished product value chain within India

- Competitive labour & energy costs

- Strong growth in domestic textile & clothing consumption, driven by multiple factors

Major growth inhibitors

- Lack of globally competitive scale

- Infrastructural issues leading to bottlenecks in an efficient supply chain

- Relatively lesser investment in highvalue added fabric & non-cotton apparel

- Inadequate availability of skilled workforce, leading to lower productivity

- Absence of free trade agreements / preferential duty access with leading importing countries like USA and European Union

The textiles industry has a pivotal position in the Indian economy. It is strong and competitive across the value chain. India has an abundant supply of raw material like wool, cotton, silk, jute and man-made fibre. In addition, India has strong spinning, weaving, knitting and apparel manufacturing capacities. Young, skilled labour is available at a reasonable cost.

Meanwhile, the size of India’s textile market is expected to touch $250 bn in the next two years from $150 bn now. We see tremendous growth potential for the textile industry and it is expected to touch $250 bn in the next two years from the present $150 bn. The domestic market is (currently) estimated at $110 bn and exports at $40 bn.

Various schemes have been launched, not only to upgrade technology but also to extend financial aid, to the sector. The capital investment subsidy announced by the Centre has been introduced in segments like weaving, garment, technical textile and made up, which has helped the sector.The govt. is also looking at modernising the machines and trying to add state-of-the-art facilities, which will help the sector. In addition, the government announced Rs. 6,000-cr special packages for the industry last year. Rebates on State levies have been introduced to encourage exports. There is an additional 10 per cent subsidy for the garment and made up segments, which means the home textile industry will get an effective 25 per cent capital investment subsidy on the new machines they bring in, leading to efficiency and modernisation of the sector. Subsidies have proved to be very beneficial for the sector and led to increases in employment and attracted huge investments. The textile industry needs to utilise the various schemes launched by the government for the benefit of customers.

Besides, India needs to invest in research and development to develop new products, reduce transaction costs, reduce per unit costs, and finally, improve its raw material base. India needs to move from the lower-end markets to middle level valuefor- money markets and export high value-added products of international standard. Thus the industry should diversify in design to ensure quality output and technological advancement.

India has made little attempt to forge partnerships – in equity, technology and distribution in overseas markets. The newer nuances of global apparel trade demand joint control of brand positioning, distributing and quality assurance systems. A great deal of work has been done by Indian trade and industry to comply with ecological and environmental regulations, and so Indian garments can adopt an appropriate label signifying a distinct quality. Efficiency and output of handloom and powerloom sectors also needs to be increased. The clothing sector needs the support of high quality and cost-effective cloth processing facilities. Modernisation of mills is a must. Human resource is another area of focus. The workforce must be trained and oriented towards high productivity.

The business environment of the future will be intensely competitive. Countries will want their own interests to be safeguarded. As tariffs tumble, non-tariff barriers should be adopted. New consumer demands and expectations coupled with new techniques in the market will add a new dimension. E-commerce will unleash new possibilities. This will demand a new mindset to eliminate wastes, delays, and avoidable transaction costs. Effective entrepreneur-friendly institutional support will need to be extended by the government, business and umbrella organisations.

Comments from Indian yarn and fabric industry…

Purushottam K Vanga Chairman, Powerloom Development and Export Promotion Council

The Indian textile industry is one of its kinds in the world. Here we can see that from hand woven fabrics to powerloom fabrics both exist, from cotton to synthetic almost all fibre base exist. As the culture of India is varied so do the Indian textile industry where traditional craft is surviving alongwith industrial products.

The fabric production in India is dived majorly between mills, powerlooms, handlooms and hosiery. Powerloom sector is producing fabrics of various origin like cotton, polyester, blended, grieg etc. and made-ups like bed linen, kitchen linen etc. Powerloom is mainly a decentralised sector, but contributing major share in production of fabrics and its export from India. About 57 per cent of the total fabric production is shared by powerloom and about 60 per cent of the fabric meant for export is sourced from powerloom sector.

The export of poweloom products from past few decades is more or less on a growth track. Currently Bangladesh, UAE, Sri Lanka, USA, Korea, are main destinations for export of fabrics. For made-ups the US, UK, Germany, France, Sweden and other European countries offers good potential for export. As the manufacturing is getting closed almost in European nations, it offers good scope for expanding the market there. Also as we are aware mostly now the garment manufacturing has shifted to Asian countries, thus fabric export to these countries are grown and thus offers scope of further expansion here.

Though of course India faces a stiff competition from Bangladesh, Pakistan and Turkey in textile export, still I would say that India is being able to create its own brand value among the global players. India is among the top exporting country for textiles and clothing. It is having a good base of raw cotton production, sufficient spinning capacity, skilled labour and also whole supply chain is available here, which serves as an advantage.

To remain globally competitive any country would require favourable trade policies and domestic environment, good raw material base, infrastructure facility, technology upgradation, R&D facility and socially secure environment. Indian powerloom sector is progressing towards all these with the help of government support and intervention by the industry stakeholders. To be competitive one of the major factor is advancement in technology. Efforts from govt. side and industry have been taken to upgrade the plain powerlooms to automatic/ shuttleless looms. Many of the big clusters of powerloom are now having Hitech looms like Ichalkaranji, Surat, and Erode etc. Most of the upgradation is being done under the scheme TUFS.

Alongwith technological development skilled manpower is also required. The availability of cheap labour in India gives an added advantage and at the same time to produce export quality products and be globally competitive, Govt. of India is taking many initiatives to promote skill development training of work force.

Also R&D sector in the field of powerloom needs improvement so that we are not dependent on imports and can get cost effective machinery and other production facility in home. Thus the growth of this sector is an amalgamation of various factors as stated above and I am hopeful that India will be a global leader in the field of textiles as was earlier. India is having a good raw material base. It is one of the largest producer of cotton and thus not dependent on import. But the price fluctuation of raw material creates a problem for further processing of it to end material.

To be competitive globally, Indian exporters require marketing support. Govt. support is required for aggressive marketing for expansion of international trade and exploring emerging markets.

Cost of Finance is a major hurdle in offering competitive rate by Indian exporters in international market. Thus Banks/Financial Institutes should extend full support to SME sector. Common Facility Centre should be established in each powerloom cluster. Anti-Dumping Duty should be imposed on fabrics so that cheaper import of fabrics from other countries, especially China hampering the domestic fabric industry can be controlled.

Vijay Puniyani Sr. Vice President Vardhman Textiles Limited

The current scenario of Indian spinning is very bad. In last three years a lot of new capacities have been installed by existing and new entrants into the market. This had been a primary reason behind creating excess capacity problem. Exports of yarns, which in 2013- 14 was 120 mn, 2014-15-16 was 100 mn, has come down to 50 mn in March – June 2017. Exports of cotton to world market has drastically reduced, reason being China diverting it sourcing to Vietnam, Bangladesh and Pakistan.

This has created lots of pressure & surplus capacity story. Due to this a lot of smaller units and medium scale units are struggling to sale their production and are suffering huge cash losses. If this situation continues many smaller units will die. Demand in the exports market is reducing and domestic market is unable to absorb the surplus production for last four years. We hope in coming few years our country’s exports resume again and everything gets stabilised.

As far as our company is concerned, we are also suffering but because of our variety offered, we are able to sustain. Moreover, to tackle this situation, we have increased our weaving capacities and converted commodity producing to value added yarns. We also have huge diversified customers base both in India and abroad. However, despite of all this our profitability has also reduced.

Our current production capacity is 1.1 mn spindles, and we are the largest one in India to produce 600 tonne yarn daily. Out of this approximately 1/ 3rd is captive, 1/3rd is exported, and 1/ 3rd is consumed by domestic market. In 2017-18 we are definitely not planning to expand our production but continue more value addition and modernization of our plants.

Shalendra Vasudeva Chief Marketing Officer Indorama Industries Ltd.

Currently, the fabric mills are kind of squeezed for margins, due to increase in input raw material cost. Most commonly used textile raw material, cotton has been at prices, higher than the expected level due to various reasons. It’s translation into prices of fabric has been a challenge, due to challenged retail sales, part of which is attributed to demonetisation step of Government of India. Currently, there appears a slowdown on account of GST, which got implemented in July. Personally, I see the future to be bright, because of lower effective cost of raw material, which shall soon get translated in the books. There is insatiable desire among youthful Indian population to embrace the fashion and lifestyle product, which shall contribute to the brighter future of over clothing and textile industry of our country.

With growing consciousness about our planet and effort to reduce carbon footprints is on. This leads to philosophy of use of greener textiles, which is biodegradable and postconsumer or post-industrial recycled stuff to be used as part of raw material. On functionality part, stretch is currently in vogue and we sincerely hope this trend of functionality to continue.

Meanwhile, there has always been competition from countries, which either have abundant availability of raw material, affordable labour or some preferential treatment for access to user countries. Pakistan, Bangladesh and Turkey all fall in either of these categories. The innovation shall take Indian mills ahead. Battle for creamier business would depend on innovation, development and speed of delivery. If not at the moment, but our mills shall make their way to edge past by improving the index of innovation. We expect govt. to reduce and the business should be done on its own merit. India is blessed with very large domestic market, which is a great boon to run a mass scale business.

Our company launched 4th generation variant of our spandex polymer, which we call I-400. It is proprietary polymer, which is resistant to chemicals, has high elongation and very high degree of inter filament cohesion. It is very friendly to work with at all levels and provides great protection to INVIYA infused garments after repeated washes.

Currently, we have 5,000 mtr of annual capacity and we export less than 10 per cent of our output. However, we are in advanced stage of capacity expansion and shall reach 12,000 mtr of annual capacity by end of 2017.

Satish K Saraf GM, Best Textiles Ltd

We being 100 per cent EOU for various types of yarns & fabrics across globe, and the major share belongs to exports only, have not seen any major changes in demand towards raising curve. China and Indonesia on other side have received tremendous response for the year. The things what lacks us behind is our government strategies on various fields which hamper Indian business in huge. FY 2017 would too be more or less the same. We don’t see any major changes or increase in demand due to change in tax reforms recently introduced.

Due to new tax reforms recently been introduced in the country, we expect lower demand across the country. Moreover small players seem to be off from the market due to this changing tax structure. With regards to issues faced, we don’t foresee any rise on demand with downgraded mechanism by the government. Government needs to concentrate on huge coming out of political reforms if they really are interested for some good news of business from spinning industry. Presently, major of the apparels are being imported into the country which are in demand despite that we have all kinds of resources for in-house production. Further government needs to decide on reducing various duty’s and should introduce new incentives for spinners and also regularise costs on labour which is presently on peak.

With this newly introduced tax GST, which is quiet complicated though simple as defined; and with numerous filings, our government has forced people to close their units. Textile was the sector where this sector had always been out of tax mode in the past. This newly introduced GST will impact textile business in all sectors in huge. We still request government to re-consider their decisions on this new tax reforms and remove textile sector from various reforms including exports. In exports, we have major issues where the finance loss is expected is from 5-10 per cent in general where drawback and other export incentives have been abolished through modified tax structure. This is going to harm international trade in long run.

As far as our company is concerned, we are planning for expansion in denim sectors which we have duly incorporated the same during the last FY; however let’s see how does new tax structure helps us gain business! We are very positive of expecting some relief’s from the government in the near future.

Vasudeo Tipre GM-Export Suryalakshmi Cotton Mills Ltd

Most of the fabric mills in India are currently facing teething issues in understanding impact of GST. Once things are streamlined & well understood by the entire value chain; hopefully we will see renewed buoyancy in the domestic markets.

When it comes to competition from Pakistan, Bangladesh and Turkey, I think Turkey is in a different league and hence can’t be considered as a competition. For Indian mills, the real competition is from Bangladesh & Pakistan. In both these countries, the major advantages vis-a-vis India are: Favourable exchange rate, special trade agreements with Europe (duty free exports) & huge vertical set-up.

For Indian mills, the strategy to mitigate the competition is to constantly work on fabric innovation. In order to build competitive advantage, it will be imperative to have quicker lead time & to maintain efficiency in production with minimum rejections. For strengthening the industry, government could support in three major areas, Infrastructure (Soft & hard), Conducive policies (FTA), offering SOPS (draw-back, TUF schemes etc.)

Our company is planning to launch fabrics having multiple fibres. While designing these fabrics, we want to give special attention to shade & softer hand feel. Our current production capacity is 40 mn yards per annum. We currently supply 40 per cent in export markets, 15 per cent in the domestic brands & 45 per cent in other domestic markets. In terms of trends, knit denim continue be in vogue for the domestic markets. New shades like brown, blue & green bottoming looks promising for the upcoming seasons. Light weight, over dyed, with peach finished is been widely appreciated for the ladies wear segments.

Sanjay Jain MD, TT Ltd.

We make carded and combed yarn in count range for 20/1 to 50/1 and plus do organic and slub yarn. We export 50 per cent. For the year 2017-18, we don’t have any new expansion plan, just trying to adjust and see how to swim through these rough times.

2016 was a very bad year as Indian cotton prices went up by 50 per cent in just 3 months while international just moved by 15 to 20 per cent – this impacted exports badly and mills even were under cash loss for a few months. Then demonestisation hit the industry badly. 2017 is better but GST has put things at a standstill.

GST has bought domestic demand to a standstill for last one month. Further post GST, drawback has come down, impacting profitability of the industry – mills are struggling at the moment – relief is only expected when new cotton season starts from October. GST is a setback to exports, as drawback has been reduced. Further due to removal of CVD, imports have also become cheaper by about 12 per cent. The industry is getting squeezed from both sides.

Sarvesh Kumar Sain GM (Sales & Marketing) Winsome Yarns Ltd

2016-17 was definitely good for all organised sectors in terms of future business opportunities. Two major decision (1- demonetization applied in 2016 & 2 – GST was assured to apply in 2017) was completely in favour of all India economy GDP. There was sudden negative impact on market for short term due to these decisions and shaken complete chain but now all organised sectors will able to see fair competition. In past 2-3 years there are huge no of spindles added but there was no synchronized increase in demand in domestic as well exports. Due to gap in demand & supply, whole spinning industry struggled with low realisation on their product. We are very much positive to increase our mélange capacity by converting our traditional product manufacturing into value added mélange products with lot of innovation in product.

We are into value addition at yarn stage which is raw material for apparel industry and still there are lots of scopes to grab the opportunity. Issue is less demand at end product within country where we are not using our major strength which is population. Government moves like “Make in India”, “Skill India”, One nation one Tax etc. will definitely boost demand within India which will reduce dependency on global market.

There is sudden negative impact & agitation from textile industry as well but it will be milestone to improve our GDP due to acceptance of fair working practices. Now all organised industries like us will be having fair competition and expecting fair product realisation. Equalizing benefits in between domestic & export will never boost export so special subsidies is the only way to boost exports. As far as our company is concerned, our product range is in value added mélange yarn where we offer lot of effects yarn & special fibre yarns as part of continuous innovation through R&D.

Durai Palanisamy Director, Pallavaa Group

Fabric mills, the construction is increasing as few new players are entering and lots of existing players are increasing their capacities. GST will create a new change especially for the man-made fibre industry. There are two major challenges that the textiles industry is facing today. In one way problem is due to inverted duty structure in terms of raw material. It creates a lot of competition between small, medium and large scale weavers. As those large mills with technical mechanism will have more advantage over power loom people who don’t have these mechanisms so they will ultimately suffer in future. Besides, there was 18 per cent duty on imports which now have been replaced by 5 per cent GST, so there will be a big challenge for domestic weaving industry to compete with those imported. The govt. should take initiatives in terms of policies to protect domestic weaving industry. So, having a uniform duty structure like cotton will help the manmade fibre industry. GST is the best thing that has happened to our country but these issues have to be sorted out so that industry could benefit out of it completely.

These days a lot of new concepts are moving towards man-made synthetic fibre industry. Due to increasing demand of manmade fibres, cotton is going to be under pressure in future. India has enough competitiveness to compete globally as we have enough tools with proper policies. But the govt. should make more industry friendly policies for betterment of the industry. E.g. Interest subvention is given to few sectors only, what about the other sectors. They should be more responsive to the industry and address its requirements as soon as possible. Our main concern is that challenges that have come up due to GST, so govt. should bring out some solution for the same. As far as our company is concerned, we have capacity close to 10 mn mtr per month. Out of this 20 per cent is exported and rest is consumed domestically.

Khagen Kashiwala Managing Director Spinning King (India) Limited

Textile industry plays vital role in boosting the economy of the nation. Its 2nd largest industry that contributes approximately 5 per cent to India’s GDP, and 13-14 per cent to overall Index of industrial production.

The Indian textile industry has the potential to reach $500 bn in size according to a study by Wazir Advisors and PCI Xylenes & Polyester. The growth implies domestic sales to rise to $315 bn from currently $68 bn. At the same time, exports are implied to increase to $185 bn from approximately $41 bn currently. The Indian textiles industry, currently estimated at around $108 bn, is expected to reach $223 bn by 2021.

These days export & corporate market is looking for sustainable, eco-friendly & green products e.g. Tanboocel – Jigao Bamboo Fibre. There are many new value added fibres, yarns & so on in fabrics too. Apart from regular products i.e. Cotton, Polyester & Viscose (with blends), the value addition in all stages have taken place. In all new fabrics; bamboo & with different blended fabrics are more in demand. As Bamboo is naturally antibacterial, very smooth, odourless (due to anti-bacterial property) breathable fibre, so as fabrics too.

Geo textiles, technical textiles, medical textiles are also fast growing segments. There are many application of Plasma technology, supercritical carbon dioxide, ultrasonic waves, electrochemical dyeing, microwave dyeing, organic natural dyes of textiles are some of the revolutionary ways to advance the textile wet processing.

Nowadays, Indian exports have become expensive due to import duty imposed by the other countries. So India has to more focus on value added products, packing & services along with consistent quality. Competition from neighbouring countries will be always in the business; to overcome the same we should develop new technology, new concepts, new ideas to boost business.

For further strengthening of this industry, we expect the govt. should do more bilateral agreements with the countries for growth in exports; Increase the exports’ incentives; Hold seminars to promote textile production upgradation, Collect the reviews quarterly directly from the exporters & manufacturers.

We, Spinning King (India) Limited is already indulged into TANBOOCEL- Jigao Bamboo Fibre in Indian market since 2003, we are the pioneer in the market for the same. Now our new inception is Speciality Weavecoats LLP, at Dhamatvan, Tal. Daskroi, Dist., Ahmedabad – a fabrics weaving plant. In the beginning we focus 80:20 domestic & exports. Gradually, we want to target export market. Our production will be 5 mn mtr annually. We have planned for 72 Brand new Picanol Summum looms. 24 looms are already in working. Our focus is new value added fabrics for shirting, suiting, Denim etc with Bamboo, linen, Ramie, Hemp, soya, milk, banana etc.

Shreyaskar Chaudhary Managing Director Pratibha Syntex Pvt Ltd

Cotton spinners in India are considering production cuts during the current financial year to sustain profit margins, which were under pressure due to a sharp increase in the price of cotton over the last few months. Experts estimate an average production cut of 15 per cent for financial year 2017-18, if the current scenario continues. We too have faced the challenge of increasing price of raw material, nevertheless we are trying to stabilise the situation by innovating and researching on exclusive products, which are cost effective.

The recent govt.’s decision of implementation of GST overall looks good for textiles in long run subject to restriction on movement of goods and refund process work smoothly. In case of exports it will have negative impact in terms of reduction in duty drawback rates, ROSL scheme announced on the same rates for 3 months but no more a support providing model, Merchandise Exports from India Scheme is continue but restriction to use it only in basic customs duty have reduced the value by 20 per cent. In case of apparel exports competition is global and export will have impact due to reduction in incentives.

Further there will be more requirement of working capital now. Further putting job work under tax net and carrying rate of 18 per cent will be undue hardship. Now even job wok of cotton will attract 18 per cent GST if it is a related process of apparel. Example, garment sewing will now falls under 18 per cent GST. Government should look into incentives to keep Indian apparel industry globally competitive.

Our company Pratibha Syntex is a large vertically integrated, sustainability oriented supplier of knitted textile products. Engineering a new business paradigm, the company streamlines the production of cotton from fiber-to-garments to reflect emerging sustainable values in textiles and fashion. The export share fluctuates as per the demand from international markets. Our per day production is around 53 tonne and monthly around 1600 tonne.

We hope that GST would be helpful by next quarter and the future for the Indian textile industry looks promising, buoyed by both strong domestic consumption as well as export demand. Thus, we at Pratibha are planning to expand on our export business by 25 per cent by the end of year 2018.

Selva Merchandising Head Sri Kalyan Export Pvt Ltd

As per present textile trends the buyers are looking for high compliance and quality standards need to be met which are to be ensured with international certifications. And we Sri Kalyan Export Private Limited knowing these requirements we are audited by international institutes and certified with compliance like GOTS, Oeko-Tex, Fair Trade, SA 8000, OCS and ISO 9001:2015 Certifications. And presently another big compliance certificate is coming up named Cradle 2 Cradle (C2C Certification) which combines material, social, safety, recycle and sustainability. We are also in early stages of Cradle 2 Cradle (C2C Certification) process. We believe that future fashion will be mostly concerned about responsible fashion, renewable fashion and sustainable fashion. Being ethical, social and responsible in textile business is must for good fashion, good water, good people and good earth. So companies only having these qualities will able to survive in future.

Today, buyers and consumers are looking for fashion goods which make no harm to nature. So based on in it Tencel is catching up more attention in fashion field as it is a sustainable fabric made of wood cellulose. Tencel is one of the most environmentally friendly regenerated fabrics. We are presently doing more Tencel dyed and printed fabrics and its finishing is specially done to give soft and shining texture finish.

Indian fabric mills facility is friendlier to do small quantity dyeing, printing, processing and finishing. Doing small quantity is giving us more advantage to attract small orders towards India. Compared to other neighbouring countries, which concentrates more on volume orders, our technology and processing is very high in terms of quality and finishing. These make our costs high and also we don’t get government support in terms subsidy like Bangladesh, Pakistan etc., still we need to be more competitive in terms of price to be globally competitive.

The government should form a committee representing all Textile Associations delegates and make a list of most urgent requirements for textile industry. This will have immediate effect on increasing the exports and need to take action on it. For example FTA with Europe is most wanted agreement which all textile people requesting from Government of India for a long time now. If implemented definitely 20-30 per cent of exports will increase immediately.

As far as our company is concerned, we manufacture and export fair trade certified textile products in fabrics, baby care products and home textiles. Our production capacity per month printed fabrics – 2,00,000 mtr, yarn dyed fabrics – 1,50,000 mtr, fabric dyed – 2,00,000 mtr kitchen linens – 1,00,000 pcs, table linens – 1,00,000 pcs, baby bedding – 10,000 pcs.

Ajay Mahajan Director, BS Overseas Ltd

Presently, the situation of fabric mills in India is bit fluid as with the implementation of GST because mills in West particularly are skeptical about implementation of GST on fabrics which has happened for the first time. Personally, I feel that scope and future for fabrics mills is quite bright and hoping for the positive developments in coming times.

Nowadays, there is lot of value addition is being done in the fabrics and lot of playing with the yarns to make the fabrics. There is hot trend for Indigo, Lycra based fabrics as well as fabrics made of Linen as well as linen blended fabrics.

Competition from Bangladesh particularly in fashion garments is immense. Can’t comment much on Pakistan but Turkey is also definitely is country to look for. As Indian fabric manufacturers we have to continuously innovate and build on the capacities. Product innovation and continuous cost control is key to success.

Last but not the least as Indian mills should focus on the deliverance and commitments. Govt is doing lot for the textiles but in any case textiles should be the priority sector and it should make investor friendly policies as well work out how the ailing industry can be brought out of Glut.

Today, our company is widely appreciated for its attributes such as timely delivery and cost effective prices. We offer wide assortment of products to our clients across worldwide. Our range includes yarns, woven, knitted and warp knitted fabrics. We are considered as one of the prominent traders, exporters and suppliers in India, dealing in more than 1,500 types of yarns/fabrics. Our vision is to be amongst the best platform for procurement of yarns and fabrics in the textile industry. Right now we are working on some fashion fabrics which we will be launching soon.

Vipin Panwar Asst. VP Marketing – Intl. Business Nahar Industries

The domestic market is down as post GST implementation most of the distribution centers are not up-to-date. Almost 90 per cent of the units are closed as they have applied and waiting for their GST numbers. But at the same time exports market is still doing OK.

Now the govt. has imposed 5 per cent GST on fabrics which has made Indian garments more expensive in overseas market. If the situation continues like this in future most of the foreign buyers are expected to shift their sourcing to Bangladesh, which offers garments cheaper than us. So, things are expected to be clear after three-more months once everything gets stabilised. Future looks absolutely blurred as nobody knows how it’s going to be till everything gets normal and international market feedback is also received.

When it comes to garments exports India is not very much competitive when compared to Bangladesh at the price part. When it comes to fabric manufacturing we are far ahead than Bangladesh, in fact are exporting the same to them at a large scale. On the other side, Pakistan is also very price competitive due to various duty drawbacks provided by their govt. When it comes to Indian fabric mills, the only drawback given to us is expected to be waved off by 2018. For the betterment of this industry and making us more competitive globally the govt should extend this drawback scheme further.

Our company Nahar Industrial Enterprises Limited, is a part of Nahar Group of Companies having a turnover of Rs`6,000 cr, out of which Rs`700 cr is of our company. Normally, out of our total production, 60 per cent is exported. But due to GST implementation we are exporting almost 80-90 per cent of the share as the domestic buyers are not placing many orders. This year our company will be installing 80 new wider width looms, to replace few of our existing and expand our capacities further. In last financial year, we also added new processing and printing machines to our capacities.

In terms of trends, these days’ stretches, basically functional fabrics are in good demand. European brands are looking for sustainable fabrics made out of recycled cotton. Most of the export buyers are shifting to organic cottons and sustainable stretched fabrics.

Ram Srinivasan, General Manager, KG Denim Ltd.

Currently, exporters and organised brand segment are doing well but unorganised segment is little bit turbulent post demonetisation and GST implementation. Competitions from Pakistan, Bangladesh and Turkish industries were always there. But recent past preferential tariff help them to get extra mileage. GST waiver for export with usual drawback will help Indian exporters to remain globally competitive. Let us wait and watch our government move.

As far as our company is concerned, we have launched manmade fibre blends and sustainable earth colour dyed fabric (replacing sulphur dyes) recently. We are launching this season with various permutation and combination. The new trends and finishes in fabrics are sustainable earth colour dyes gaining momentum and performance finishes like fade resist colours and repellent to water/ stain on high demand and are capitalizing the same.

Abhay Kumat, CEO, Kamadgiri Fashion Ltd

Mills normally means integrated production facility from spinning to processing. There is not much production in mills and maximum 5 per cent of total production is done by organised mills. However, unorganised sector is getting stronger every day.

When it comes to new trends and finishes in fabrics,Easy Care Finishes are in demand these days. Cotton feel is in trend even is synthetics smooth & soft touch is admired by customers. I don’t know much about growing competition from Pakistan, Bangladesh and Turkey. We know Indian trends better so we can face competition.

For further strengthening of this industry, we expect that GST rates should be fibre neutral. Credit policy should be textile friendly. There should be workman subsidy for new apparel manufacturing unit as they have announced in Orissa (3,000 per worker for three year for new employment). Our company produces 80 lakhs mtr fabric per annum and 30 lakhs garment per annum. We have launched Giza Cotton Yarn Dyed suiting and introducing more option in the same.