Bangladesh’s ready-made garment (RMG) sector sees renewed hope of earning higher foreign exchange as the United States introduces a relatively favourable tariff on Bangladeshi goods compared with its competitors, amid internal instability and global conflicts.

However, the industry also faces a looming challenge in the European Union (EU), as Bangladesh is set to graduate from the Least Developed Country (LDC) category in November 2026, which will result in the loss of duty-free access to many key markets, particularly in Europe.

Industry insiders and trade experts have urged the government to seek an extension of the LDC graduation timeline and adopt prudent measures to maximise the benefits of the US tariff regime. They also called for strategic steps to secure the advantages of the EU’s Generalised Scheme of Preferences Plus (GSP+). They noted that Bangladesh currently enjoys a better competitive position as the US administration has imposed higher tariffs on China and India – two of its main rivals in the global apparel market – creating opportunities for Bangladesh to emerge as an alternative sourcing hub for international retailers and brands.

Former US President Donald Trump recently announced his administration’s intention to impose 100% tariffs on all Chinese imports by 1 November or sooner. Earlier, on 31 July 2025, the US government had imposed a 25% tariff on Indian goods entering the American market, 20% on imports from Bangladesh, Vietnam and Sri Lanka, 19% on Thailand, Pakistan, Malaysia, Cambodia and Indonesia, and 15% on Turkey.

RMG Sector Drives Bangladesh’s Economy

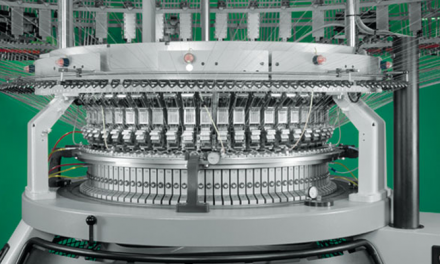

The garments and textile sector contributes around 12% of Bangladesh’s GDP, indirectly supports the livelihoods of 40 million people, and directly employs around 4 million workers. It accounts for more than 80% of the country’s total export earnings. In the fiscal year 2024–25, Bangladesh’s total exports stood at US$48.28 billion, of which the RMG sector contributed US$39.35 billion – 81.49% of total export earnings. Entrepreneurs have projected export targets of US$100 billion by 2030.

Multiple Challenges Grip the RMG Industry

According to Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) President Mohammad Hatem, 258 factories have closed over the past year, reflecting the industry’s crisis. Out of 1,414 trade unions in the sector, 905 are currently inactive. BGMEA President Mahmud Hasan Khan noted that the entire manufacturing sector, including RMG, is experiencing unprecedented challenges both nationally and globally.

“In such a context, the interim government has recently provided policy and final approval for the ‘Bangladesh Labour Law Amendment Ordinance 2025’. Unfortunately, the advisory council granted approval unilaterally, disregarding the recommendations of the Tripartite Consultative Council (TCC),” he said.

Mahmud explained that the initial proposal allowed the formation of a trade union with the consent of at least 50 workers in factories employing 50 to 500 workers. However, in a later meeting, the advisory council changed the requirement to a minimum of 20 to 300 workers, dividing it into five phases. He added, “We firmly believe in workers’ welfare and are continuously working to improve factory environments and working standards. Labour laws must be balanced and realistic for both workers and employers. Therefore, I urge the government to reconsider the approved Labour (Amendment) Ordinance 2025 to ensure sustainable industrial growth rather than weaken competitiveness.”

Buyers’ Orders Decline Amid Rising Costs Salauddin Chowdhury, senior director of the Europe-Bangladesh Federation of Commerce and Industry (EBFCI), said many factory owners are struggling to operate due to declining orders and reduced payment offers from buyers. “After the US tariff issue, many buyers cancelled orders and the sector continues to suffer. While the government handled the tariff situation commendably, we must continue negotiations with the US authorities to further reduce tariffs,” he said. He added that the US tariff shock was a wake-up call for the industry to diversify markets and products.

Port Charges and Costs Add to Industry Woes

The BGMEA President highlighted a series of cost escalations hitting the sector, “We are already facing tariffs on exports to the US market. Operational costs are soaring due to high interest rates on bank loans, a 56% wage hike effective from December 2024, a 9% rise in annual increments, increased gas and diesel prices, and a 60% cut in export incentives since 2023.

“To compound this, service charges at Chittagong Port have recently increased by about 41%. Such unilateral decisions are detrimental to both the industry and the wider economy.”

Mahmud, who also serves as Managing Director of Rising Fashions Ltd, urged the government to enhance port efficiency, reduce transport time between Dhaka and Chattogram from 7–8 hours to 3–4 hours, and ensure uninterrupted energy supply for industries.

Call to Delay LDC Graduation to 2032

Having met all three United Nations graduation criteria – Gross National Income (GNI) per capita, Human Assets Index, and Economic Vulnerability Index – Bangladesh is poised to graduate from LDC status in November 2026.

Upon graduation, the country will lose duty-free and quota-free market access to major destinations such as the EU, Canada and Australia. For the RMG sector, tariffs of 10–12% could significantly erode competitiveness unless productivity rises and diversification into higher-value apparel occurs.

Global trade trends add further complications. Rising protectionism, complex supply-chain standards, and non-tariff measures such as carbon border taxes and due diligence laws are reshaping trade. Sustainability, traceability, and labour compliance are becoming key differentiators in the global apparel market.

Experts argue that Bangladesh must implement structural reforms – simplifying taxation and customs procedures, improving contract enforcement, and expanding digital governance – to attract quality investment and improve the ease of doing business. They also stress that LDC graduation presents an opportunity to diversify beyond garments into IT, pharmaceuticals, leather, agro-processing, services and shipbuilding.

BGMEA President Mahmud Hasan Khan urged the government to seek a deferment of LDC graduation until 2032. “There is no readiness for graduation. Bangladesh has yet to sign any Free Trade Agreement (FTA), Preferential Trade Agreement (PTA) or Economic Partnership Agreement (EPA) to facilitate post-LDC trade. Our industries could face serious threats without adequate preparation,” he said. He emphasised the need for a business-friendly environment, low-cost financing, resolution of the gas crisis, and improved logistics and infrastructure.

Salauddin Chowdhury added, “Many Western countries are willing to support us. Businesses are not ready to graduate by 2026. After years of economic strain, we need at least three more years. If income falls while standards rise, it will not be sustainable.” He also noted that Bangladesh has 268 LEED-certified factories as of 25 October, with owners investing millions to achieve this, yet still receiving inadequate prices from buyers.