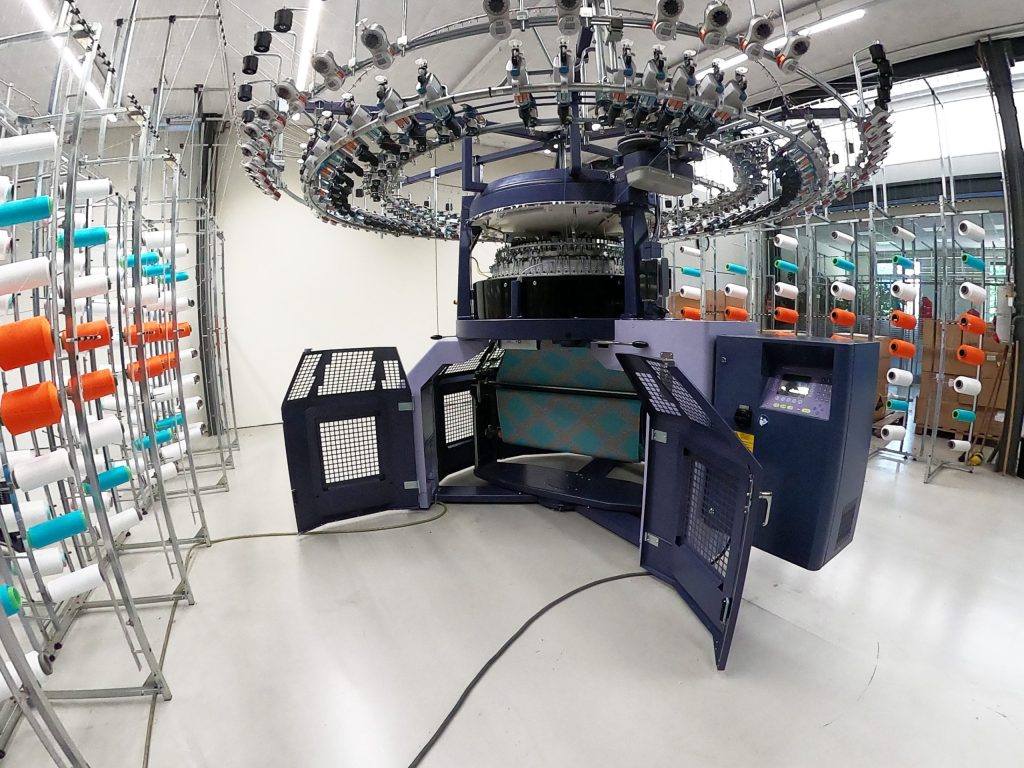

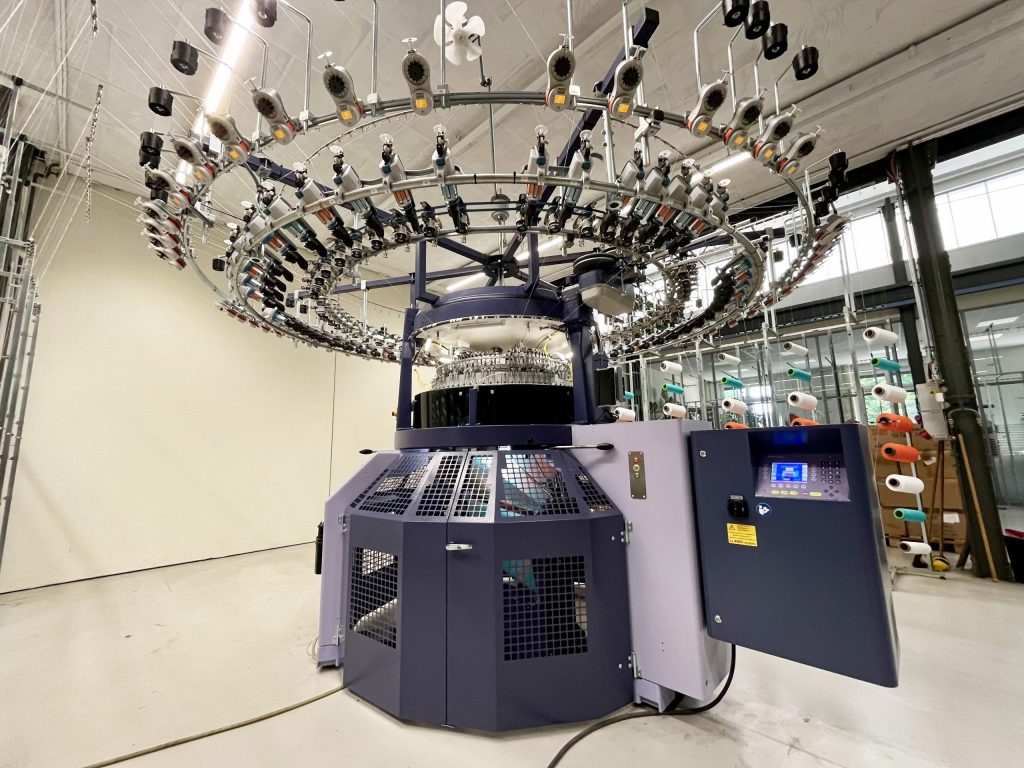

Terrot Textilmaschinen GmbH has unveiled the new T-Frame, a universal machine frame platform for large-diameter circular knitting machines. Designed to meet growing demands for flexibility, stability, and operational safety, the T-Frame provides a next-generation foundation for both current and future industrial knitting machines, combining German engineering expertise with a modular, future-ready design approach.

Terrot Textilmaschinen GmbH has unveiled the new T-Frame, a universal machine frame platform for large-diameter circular knitting machines. Designed to meet growing demands for flexibility, stability, and operational safety, the T-Frame provides a next-generation foundation for both current and future industrial knitting machines, combining German engineering expertise with a modular, future-ready design approach.

Industry relevance & market context

Circular knitting producers worldwide are facing growing pressure to increase output flexibility while maintaining consistent fabric quality under tighter cost and labor constraints. At the same time, demand for ergonomic operation, machine safety and sustainable production concepts are rising. The T-Frame directly addresses these challenges by combining mechanical robustness with smart structural design, enabling manufacturers to respond faster to market changes without compromising process reliability.

Technological core

With the T-Frame, Terrot introduces a newly engineered tubular machine frame made from premium steel, developed to handle higher mechanical loads while improving precision and machine accessibility. After nearly three decades of proven large-diameter machine concepts, the company as completely redesigned the frame architecture.

At the core of the innovation is an intelligently welded frame construction that combines structural rigidity with modular adaptability. A single, standardized frame platform supports multiple extraction and take-down variants, reducing mechanical complexity while enabling fast configuration changes. Integrated cable routing, centralized display positioning and optimized component layouts replace traditional add-on solutions and improve both ergonomics and safety.

Industrial benefits & business impact

The T-Frame platform delivers measurable advantages in daily production environments:

The T-Frame platform delivers measurable advantages in daily production environments:

• Operational flexibility: One universal frame supports multiple machine configurations, enabling rapid adaptation to changing fabric requirements.

• High productivity: Increased structural stability guarantees knitting precision at industrial speeds, particularly in large diameters ranging from 26 to 54 inches.

• Improved efficiency: Standardized components and optimized accessibility reduces setup times and simplifies maintenance routines.

• Enhanced safety & reliability: Intelligent cable management and reduced external attachments minimize failure points and support long-term process stability.

• Future readiness: The platform is designed to accommodate upcoming machine generations, protecting customer investment.

“With the T-Frame, we have focused on the foundation of machine performance,” said Michael Lau, Head of R&D at Terrot. “By rethinking the frame architecture, we deliver higher stability, easier handling, and a level of flexibility that meets current production needs while enabling future technological developments.”

Terrot T-Frame platform is available for large-diameter tubular circular knitting machines in multiple frame sizes and configurations. The development stands for transformation in textile manufacturing, combining the company’s long-standing engineering expertise with a clear commitment to future-oriented, user-friendly production processes. Visitors can experience the new T-Frame live at various upcoming trade shows, where Terrot will demonstrate the next level of circular knitting technology.

FIEO’s Budget recommendations by Mr S C Ralhan, President, FIEO

1) Address Cost & Competitiveness Issues

1) Address Cost & Competitiveness Issues

Proposal: The Budget should urgently address the problem of inverted customs duty structures, where import duties on raw materials, components, or intermediates are higher than those on finished goods. FIEO recommends rationalisation and reduction of import duties on key inputs used by export-oriented industries so that input costs are aligned with finished product duties.

Justification: An inverted duty structure significantly erodes the cost competitiveness of Indian exporters and locks up scarce working capital through accumulated input tax credits. Several sectors continue to face this anomaly. For instance, synthetic yarns and fibres attract higher customs duties than finished fabrics and garments, adversely impacting the textile and apparel value chain. Similarly, electronic components such as PCBs, connectors, and sub-assemblies face higher duties compared to imported finished electronic products, discouraging domestic value addition. In the chemical and plastics sector, basic raw chemicals and polymers often attract higher duties than downstream finished products, undermining Indian manufacturers. The leather and footwear sector also faces higher duties on inputs like components and accessories vis-à-vis imported finished footwear. Correcting these anomalies by lowering or restructuring duties on raw materials will reduce production costs, ease working capital pressures, encourage domestic manufacturing, and strengthen India’s export competitiveness.

2) Shipping Support

Proposal: The Budget should provide targeted policy and fiscal support for the development of Indian global-scale shipping lines, including access to long-term finance, viability gap funding, and supportive regulatory measures.

Justification: India’s heavy dependence on foreign shipping lines exposes exporters to high freight costs, supply disruptions, and volatility in global shipping rates. The absence of strong Indian shipping carriers weakens India’s trade resilience and bargaining power. Developing Indian shipping lines can significantly reduce freight costs, improve reliability, and ensure strategic control over logistics. It is estimated that India could save USD 40–50 billion annually in freight outflows through a robust domestic shipping ecosystem. This would directly enhance export competitiveness and support India’s long-term trade and logistics security.

3) Fiscal & Tax Incentives – R&D Support

Proposal: FIEO recommends restoring the 200-250% weighted tax deduction for in-house R&D expenditure under Section 35(2AB) of the Income Tax Act and broadening its applicability beyond companies to include LLPs, partnership firms, and proprietorships, especially MSMEs.

Justification: Historically, the 200% weighted deduction significantly incentivised private sector investment in R&D and innovation. Its gradual dilution has weakened India’s innovation ecosystem at a time when global competition is intensifying. Currently, 35 out of 38 OECD countries provide tax incentives for R&D, putting Indian exporters at a disadvantage. Giving the 200% deduction would encourage innovation linked to productivity, product development, and export competitiveness. Extending eligibility to non-corporate entities is critical, as MSMEs form the backbone of India’s export ecosystem and often lack the financial capacity to invest in R&D without fiscal support.

4) Tax Support for Overseas Marketing

Proposal: The Budget should provide a 200% tax deduction for expenditure incurred on overseas marketing, branding, trade fairs, buyer meets, and promotional activities, particularly benefiting MSME exporters.

Justification: India’s goods and services remain inadequately showcased in global markets compared to competing exporting nations. High marketing and branding costs discourage exporters-especially MSMEs-from aggressively pursuing new markets. Enhanced tax deductions would incentivise exporters to invest in international marketing while reducing the effective fiscal burden. This measure would lead to stronger brand visibility, market diversification, higher exports, and improved long-term trade sustainability.

5) Extension of the 15% Concessional Corporate Tax for New Manufacturing Units

Proposal: FIEO proposes extending the 15% concessional corporate tax rate under Section 115BAB for new domestic manufacturing units for at least another five years beyond the earlier cut-off date of 31 March, 2024.

Justification: At a time when India is competing aggressively for global manufacturing investments and supply-chain relocation, the lapse of this concessional tax regime reduces India’s attractiveness as a manufacturing destination. Extending the scheme would provide policy certainty, improve post-tax returns on investment, and reinforce the Government’s Make in India and export-led growth objectives. This measure would also complement PLI schemes by creating a coherent and competitive fiscal framework, encouraging fresh capital investment, employment generation, and higher value-added manufacturing in India.