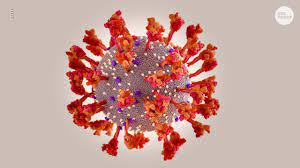

Though the impact of the Omicron variant remains highly uncertain, future business expectations also remained largely unchanged, as any concerns over disruptions caused by rising case numbers were largely offset by the improving supply situation and growing hopes that any disruptions would be modest compared to prior waves, London-based IHS Markit said.

Though the impact of the Omicron variant remains highly uncertain, future business expectations also remained largely unchanged, as any concerns over disruptions caused by rising case numbers were largely offset by the improving supply situation and growing hopes that any disruptions would be modest compared to prior waves, London-based IHS Markit said.

An unchanged JPMorgan global manufacturing purchasing managers’ index (PMI) reading in December 2021 masked improvements in various sub-indices: factory production growth accelerated, supply disruptions eased, safety stock building was less evident and price pressures abated, according to IHS Markit, which compiled the index.

The JP Morgan global manufacturing PMI held steady at 54.2 for a third successive month in December. While signalling an encouraging resilience in the overall health of the manufacturing economy in the face of the COVID-19 Omicron variant, the survey’s sub-indices, including some of the key components of the PMI itself, brought even better news.

December saw growth of factory output accelerate to the fastest since July, broadly matching the expansion of new orders for the first time since February last year. Whereas in recent prior months production growth had lagged demand growth to an unprecedented degree barring a brief spell in 2009 as factories simply could not produce everything being demanded by their customers, December has seen production and demand growth come back into line.

The biggest shortfall of production relative to demand was recorded in Italy followed by the United States, Australia and South Korea. France, Vietnam, Taiwan, the United Kingdom, Canada, the Philippines and Germany all also reported production deficits relative to orders. However, the US production deficit was the smallest since February while the eurozone deficit as a whole was the smallest for three months, IHS Markit said.

In contrast, a surplus of production relative to new orders was witnessed in Thailand, Indonesia, China, as well as Spain, Japan, Russia and several other central and eastern European economies. Across Asia as a whole, the production surplus was the largest since August 2020.The faster output growth (and reduced production shortfall) in December was largely attributable to companies reporting fewer production constraints due to staff or raw material shortages.

Key to the easing of the production constraints was an alleviation of supplier delivery delays in December. Although still running at a level far in excess of anything seen prior to the pandemic, the average lengthening of supplier delivery times globally eased for a second consecutive month in December to the smallest recorded since March.

In many instances, suppliers had been able to raise capacity to meet demand for inputs from manufacturers, though problems persisted in shipping these goods to factories, with the number of companies reporting shipping delays continuing to run at around eight times the long-run average, pointing to a continued worrying – and unprecedented – logistical issue which remains unresolved. However, even these shipping delays showed some signs of moderating in December.

Suppliers’ delivery times continued to lengthen most notably in the United States and Europe, though to significantly lesser extents than in prior months. Delivery lead times lengthened to the least extent for seven months in the United States, ten months in the eurozone and 12 months in the United Kingdom. The latter nevertheless saw the longest lead-time extension of any country other than the Netherlands, in part reflecting additional issues relating to Brexit.

Far fewer delays were recorded in Asia, with China, in particular, seeing especially modest disruptions to supply chains.The ongoing stress on supply chains and shipping times was exacerbated by stock building in December, especially as manufacturers continued to purchase additional inputs in an attempt to safeguard future production. An easing in the rate of increase of manufacturers’ input costs accompanied the cooling of supply chain pressures.