The announcement of the India Budget 2024–25 by Finance Minister, Nirmala Sitharaman recently elicited different reactions from the textile industry. While certain measures have garnered praise for their capacity to boost business and jobs, others have voiced concerns about the industry’s lack of comprehensive support. Numerous measures for MSMEs and skill development for the textile and apparel industries were included in this. Although the garment and textile industries responded favourably overall, industry leaders believe more should have been done. In next few pages we are covering reactions from the industry leaders and major associations.

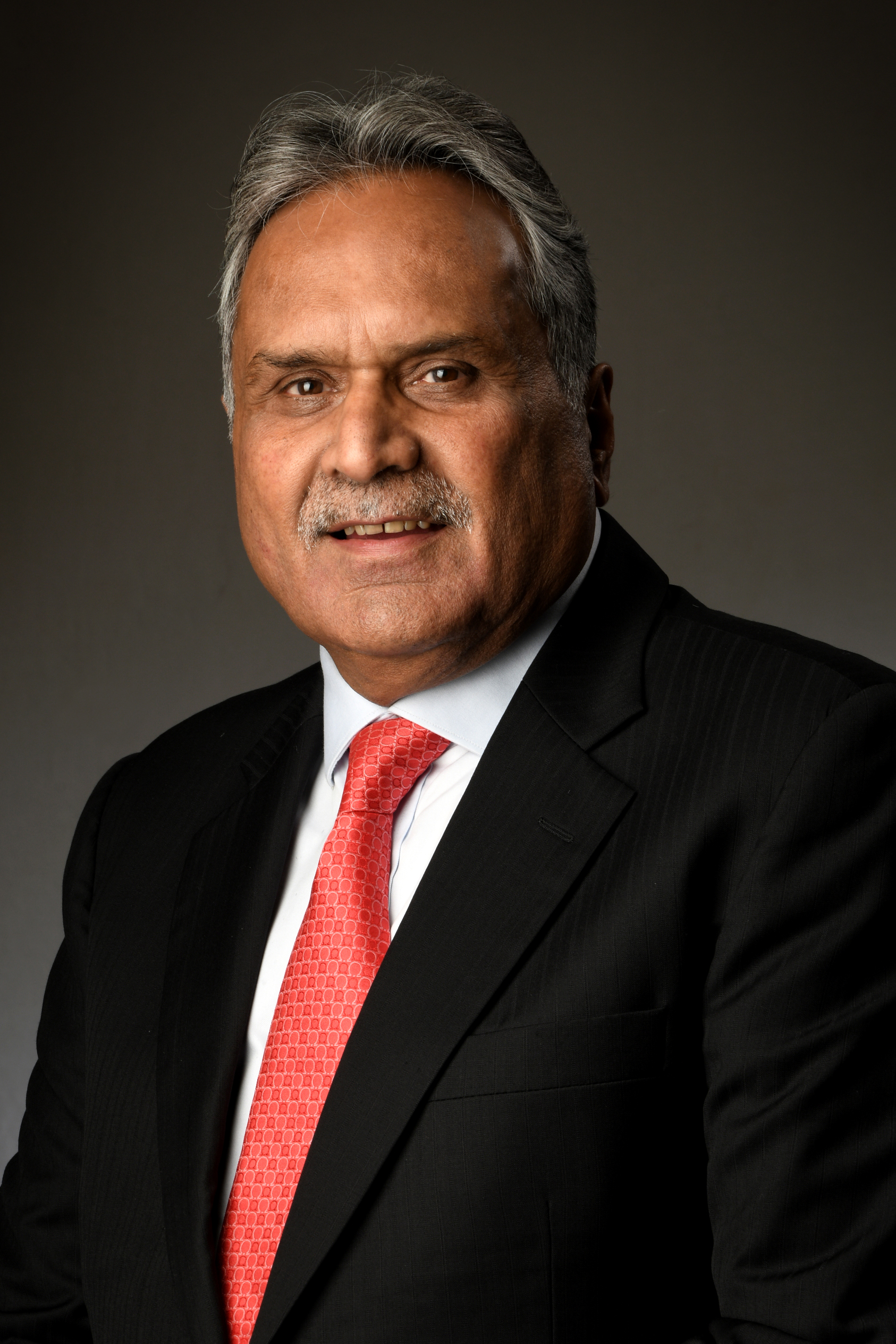

Sudhir Sekhri, Chairman, Apparel Export Promotion Council (AEPC)

This budget underlines the progressive vision of the government for holistic growth and steps to reach Vikshit Bharat. The garment industry hails the acceptance of the demand of AEPC by expanding the list of trims and embellishment under IGCR, which will help the RMG industry thrust exports.

The enhancement of limit under credit guarantee scheme for MSMEs in manufacturing sector, grant of one month wage to new entrants in all formal sectors up to Rs 15,000, EPFO contributions for new manufacturing employees for four years, incentives for setting up of women hostels, dormitories and crèches and upgrading the industrial training institutes will help the garment industry scale up and be future ready.” Enhanced support to Cotton Corporation of India will help stabilize the cotton prices, he added.

This Budget is balanced, reform oriented and forward looking. It has taken care of both the growth of the economy and the geo- political consideration of the time, Chairman AEPC added.

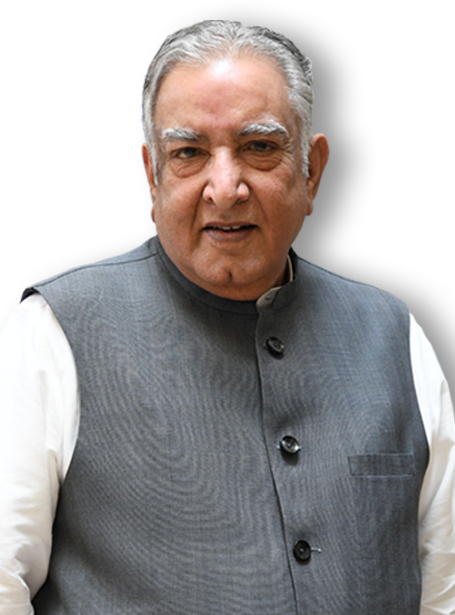

Rakesh Mehra, Chairman of the Confederation of Indian Textile Industry (CITI)

Rakesh Mehra, Chairman of the Confederation of Indian Textile Industry (CITI)

Congratulating the Hon’ble Minister of Finance, Nirmala Sitharaman for presenting her 7th Finance Budget, Rakesh Mehra, Chairman of the Confederation of Indian Textile Industry (CITI) cited the budget as a forward-thinking budget that addresses several key issues for the overall growth of the Indian economy.

However, the stagnation in the textile and apparel industry needed some bold measures for capacity building, modernisation and cost competitiveness. “MSME accounts for about 80% of the Indian Textile Industry. The credit assurance schemes announced today will provide the much-needed impetus to the growth of large number of textile and garment MSMEs and enable them to expand their operations and innovate.” said Mehra.

He appreciated the recognition of e-commerce as an engine for growth of trade and applauded the announcement of e-Commerce hubs. The “plug and play” industrial parks, support towards setting up of working women hostel, etc. will also pave the way for a more robust and sustainable industrial ecosystem.

The increased focus of Government towards skilling and the announcement of the Employment Linked Incentive scheme coupled with the decision of easing the FDI norms will facilitate new investments in the textile industry. Moreover, the financial support for clean energy transition, energy initiatives, and energy audits underscores the Government’s commitment to sustainable development. “We believe that these initiatives will pave the way for a more robust and sustainable industrial ecosystem”, he said. The various benefits provided through income tax relaxation will also increase purchasing power of the consumers which may translate to improved domestic demand for the textile industry.

Mehra said that though “the Hon’ble Minister has addressed the need for boosting competitiveness of domestic manufacturing in her speech today, however, the downstream textile industry is suffering from non-availability of raw material, both cotton and man-made fibers at international competitive prices.” This has resulted in Indian textile industry not being able to leverage our unique strength of presence across the value chain and resulted in increased imports of value-added products over the years.

Moreover, after the expiry of the TUFS scheme in March 2022, the industry has no investment incentivisation scheme for expansion or modernization. Scaling up will be critical for the survival of the industry, which has been fast losing out to our competitors largely due to lack of scales. “With the exception of enhanced PLI scheme allocation to Rs 45 cr from earlier Rs 5 cr, there is no major announcement to address the industry’s loosing competitiveness”, Mehra observed. The PLI scheme has not been able to address the investment needs of the large majority. Revival of capital subsidy schemes will be needed to ensure large-scale investments. ‘Viksit Bharat’ would need some more bold steps for the revival of this employment generating sector. “We look forward to measures to address these issues”, he said.

Dr. S. K. Sundararaman, Chairman, The Southern India Mills’ Association (SIMA)

Dr. S. K. Sundararaman, Chairman, The Southern India Mills’ Association (SIMA)

The pathbreaking initiatives taken for the MSMEs are significant relaxation in the eligibility criteria for MSME by increasing the asset value of Rs.50 crores and annual sales turnover of Rs.250 crores and the said measures have enabled more than 80% of the textile manufacturing units in the country to get qualified under MSME category. This has greatly benefited the industry during lockdown and post-lockdown periods.

Dr. S.K. Sundararaman, Chairman, SIMA has stated that employment, skilling and MSMEs being the major themes of the Union Budget, the various announcements relating to these areas would benefit the labour intensive textile industry. He has said that the industry has been demanding the Government to announce a separate scheme for credit guarantee facility, as the highly vulnerable textile industry has been often facing financial stress due to external factors. He has said that the industry has been reeling under long drawn recession since April 2022. He has welcomed the announcement of Credit Guarantee Scheme for MSMEs and facilitating term loans for purchase of machinery and equipment without collateral or third-party guarantee cover upto Rs.100 crores while the loan amount may be larger. He has also welcomed the mechanism for facilitating the continuation of bank credit to MSMEs during their stressed period while being in SMA stage for the reasons beyond their control to continue their business and avoid getting into the NPA stage.

SIMA Chairman has welcomed the announcement of reducing the BCD on Methylene diphenyl diisocyanate (MDI) used for the manufacture of spandex yarn from 7.5% to 5% to address the duty inversion, enhancing the global competitiveness of textile goods manufacturers using such yarn. He has said that use of spandex yarn has been increasing exponentially and hoped that the domestic manufacturers of spandex yarn would pass on the benefit to the downstream sectors.

SIMA Chairman has welcomed the allocations granted by the Finance Ministry for exports i.e., RoDTEP and RoSCTL with an increase of 5.8% and 10% for the year 2024-24 as compared to 2023-24, a much-needed boost when the textile exports are on the downward trend due to various external factors.

Dr.Sundararaman has lauded the Employment Linked Incentive Scheme that would reimburse EPFO contributions of employers’ upto Rs.3000/- per month for two years for the new recruits. He has welcomed the announcement of one month wage to new entrants in all formal sectors in three installments upto Rs.15,000/-.

Various announcements made for strengthening the infrastructure facilities like road, port, water ways, airport, etc., would reduce the logistics and transaction cost and thereby enhance the global competitiveness. The announcement made for agriculture would benefit the cotton farmers to improve their productivity, increase the area under natural farming, etc., and thereby the predominantly cotton based textile industry would be the beneficiary. The increase in limit of MUDRA loans from Rs.10 lakhs to Rs.20 lakhs would benefit small traders, handloom and power loom weavers in the textile industry, says SIMA chairman. He said that announcement of 12 industrial parks with plug and play facility, rental housing with dormitory type accommodation in PPP mode would also benefit the textile industry. He has said that the announcements made with regard to energy security, innovation, research and development and regular allocations made for textile industry towards TUF Scheme, skill development, PLI, NTTM and PM-MITRA Park would enable the industry to march ahead.

Rahul Mehta, Chief Mentor, Clothing Manufacturers Association of India (CMAI)

Rahul Mehta, Chief Mentor, Clothing Manufacturers Association of India (CMAI)

“This budget is extremely pragmatic and innovative in some of the bold decisions and directions it has taken to encourage employment directly. The steps include an internship scheme, the decision to reimburse one month’s wages for new employees, and subsidies for employees earning over a lakh of rupees. These are excellent steps being taken. However, there are many open-ended areas at this point, and we await the details before making specific suggestions. Nonetheless, this is a visionary, pragmatic, and very innovative budget that the Finance Minister has presented. Whilst most of these measures are for all industries, they will likely benefit the textile and apparel industry equally, if not more, since it is more labour-oriented. Therefore, we are confident it will benefit the apparel industry.

Furthermore, additional measures announced to support bank credits to MSME’s and easing of foreign investment will also benefit textile and apparel industry. The import relaxation in some of the important raw materials, trims and accessories required for garment manufactures will also help the garment manufacturers to be more competitive, especially in the Export markets.

Kumar Rajagopalan, CEO, Retailers Association of India (RAI)

Kumar Rajagopalan, CEO, Retailers Association of India (RAI)

The government has tried to strike a balance between populist and policy measures. RAI appreciates the government’s focus on empowering the middle class and rural population. Initiatives such as monetary support for farmers, higher exemption limits in personal income tax, and increased standard deductions will provide higher disposable income, leading to increased spending. We believe this will stimulate consumption growth, thereby boosting the overall economy. The reduction of duty on gold, precious metals, and mobile phones will also provide a significant boost to these sectors, particularly during the festive season.

The government’s commitment to skilling and employment support, including initiatives for youth employment and skilling programs, is another commendable aspect of the budget, ensuring a future-ready workforce in the retail sector.

The budget’s emphasis on MSMEs and startups, including enabling more lending and abolishing angel tax, is a positive step towards realizing their potential. Tax simplification and compliance, which are crucial needs of the hour, have also been addressed. Additionally, the Employment Linked Incentive, offering reimbursement to employers up to Rs. 3,000 per month for two years towards their EPFO contribution for each additional employee, is a welcome move.

The establishment of working women’s hostels and creches in collaboration with the industry is an essential measure for supporting women working in the retail sector. The focus on developing infrastructure for shopping in urban development is a significant step forward.

KM Subramanian, President, Tiruppur Exporters Association (TEA)

KM Subramanian, President, Tiruppur Exporters Association (TEA)

The Tirupur Exporters Association welcomes the Central Budget for the year 2024 – 25 with major emphasis on four thrust targets, namely agriculture, youth, Middle income group and women. The following announcements in the Budget would have positive impact for the readymade garment industry.

Employment and Skills Development

• Three schemes for employment and skill development have been announced in the Union Budget 2024-25

1. One month salary subject to a maximum of Rs.15000/- will be given to every newly employed youth in three installments. This will benefit 2.1 cr youth

2. Government will subsidize up to Rs.3000/- on Provident Fund contribution of entrepreneurs for newly created jobs. The scheme will be implemented for two years for all new workers. 50 lakh new jobs will be created through this

3. Subsidy for first four years through Provident Fund to all newly employed workers and entrepreneurs to benefit 30 lakh youth

• 20 lakh youth will get skill training in five years

• 1000 vocational training institutes will be developed

• Curriculums will be designed to provide industry-specific training

Manufacturing and Services (MSME)

• A new loan appraisal model for MSME loans will be established for banks avoiding BASEL III

• A Government loan guarantee scheme for MSMEs up to 100 cr in the manufacturing sector will be implemented.

• Adequate credit assistance will be provided to MSMEs when they face financial constraints and fall under Stressed Asset Category

• The limit for Mudra loan scheme will be increased from 10 lakhs to 20 lakhs

• 12 Industrial Parks will be set up with plug and play facilities through Central/State Governments and Entrepreneur Partnership (PPP).

• Dormitory type rental houses will be built under PPP model for the convenience of industrial workers

• 1 cr youth will be offered internship and imparted job training in 500 leading companies with stipend of Rs.5000/- per month. Also, a one-time incentive of Rs.6000/- will be provided through CSR contribution of the company

• Reduction of duty on import of accessories required for manufacture of garments

• Power generation through rooftop solar will be encouraged

• One lakh cr will be earmarked for research and development

• 11 lakh cr capital will be earmarked for infrastructure development

• GST procedural issues will be eased

• Standard Operating Procedure will be implemented for TDS Deduction.

• Standard Deduction limit in Personal Income Tax increased from Rs.50,000/- to Rs. 75,000/-

Further, we look forward to announcements on import of garments and textiles from Bangladesh, Alternate scheme for TUF, interest subsidy on packing credit loan to exporters, extension of ECLGS etc. soon.

Ashwani Kumar, President, Federation of Indian Export Organisations (FIEO)

Hailing the Union Budget, Ashwani Kumar, President, FIEO said that the budget has focused on growth potential of the Indian economy by focusing on farmers, poor, youth and woman. It has also created a long-term roadmap in pursuit of not only keeping the country as the fastest growing economy but also developing it as Viksit Bharat. Mr Ashwani Kumar said that the Budget theme of employment, skilling, MSMEs and middle class will further give boost to manufacturing and exports besides attempting imports substitution.

FIEO President said that priority to productivity and resilience in agriculture by transforming agricultural research is the key to further giving boost to the sector. Natural farming along with Shrimp production & export and digital public infrastructure will help in fast-tracking growth of rural economy and generation of employment opportunities on a large-scale with a budget provision of 1.52 lakh crore for agriculture and allied sector. Scheme for Job Creation in manufacturing will also incentivize additional employment in the manufacturing sector, thereby giving boost to exports, said Mr Kumar.

The budget also provides special attention to MSMEs and manufacturing, particularly labour-intensive manufacturing by formulating a package covering financing, regulatory changes and technology support for MSMEs to help them grow and also compete globally. Besides, Credit Guarantee Scheme for MSMEs in the manufacturing sector and especially during stress period is yet another initiative announced in the Budget that will help the trade and industry in a big way to come out situation and challenges like Covid-19 pandemic, added FIEO President. Further to facilitate MSMEs to unlock their working capital by converting their trade receivables into cash, proposal to reduce the turnover threshold of buyers for mandatory onboarding on the TReDS platform from 500 crore to 250 crore is a welcome step. Besides, financial support for setting up of 50 multi-product food irradiation units in the MSME sector and setting up of 100 food quality and safety testing labs with NABL accreditation is a boon for the businesses, said Mr Ashwani Kumar.

FIEO Chief reiterated that setting up of E-Commerce Export Hubs under PPP mode will enable MSMEs and traditional artisans to sell their products in international markets and promote trade and export related services under one roof. This will also further help in promoting the Districts as Export Hubs and One District One Product schemes of the government thereby promoting GI products and handicraft goods, showcasing such products for the benefit of artisans, craftsman and farmers increasing their income many folds.

FIEO Chief also said that the proposal for ownership, leasing and flagging reforms, which will be implemented to improve the share of the Indian shipping industry and will generate more employment, is also a favourable initiative by the government, as proposed by FIEO during its Pre-Budget consultation. Purvodaya, for the all-round development of the eastern region of the country including Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh, which will cover human resource development, infrastructure and generation of economic opportunities will make the region an engine of growth to attain Viksit Bharat goal.

Ashwani Kumar also said that one of the key announcements in the Budget has been a roadmap for moving the ‘hard to abate’ industries from ‘energy efficiency’ targets to ‘emission targets’ to be formulated soon for which appropriate regulations for transition of these industries from the current ‘Perform, Achieve and Trade’ mode to ‘Indian Carbon Market’ mode will be put in place. An investment-grade energy audit of traditional micro and small industries in 60 clusters, including brass and ceramic and financial support for shifting them to cleaner forms of energy and implementation of energy efficiency measures will also be replicated in another 100 clusters in the next phase, thereby making them future ready to tackle CBAM and other environmental norms as proposed by developed world.

FIEO Chief also added that to enhance the competitiveness of exports in the leather and textile sectors, reduction in BCD on real down filling material from duck or goose and making additions to the list of exempted goods for manufacture of leather and textile garments, footwear and other leather articles along with simplification and rationalisation of export duty structure on raw hides, skins and leather is another booster for the exports sector during such challenging times.

FIEO President further reiterated that the announcements made in the Budget will soon unable our country to be become the third largest economy and will play a key catalyst role in making India, ‘Viksit Bharat’ in times to come ensuring inclusive growth, benefiting every segment of society.

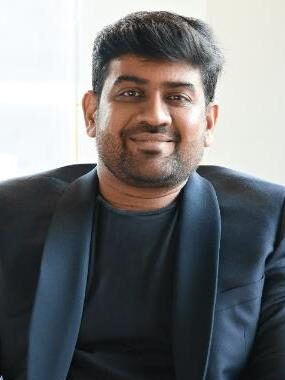

Ritesh Khandelwal, Co-Founder, ZYOD

Ritesh Khandelwal, Co-Founder, ZYOD

The focus on manufacturing and MSMEs in this year’s budget is a welcome development. The Prime Minister’s package of 5 schemes, especially the ‘job creation in manufacturing’ and ‘Credit Guarantee Scheme for MSMEs in the manufacturing sector’, promises significant growth for the sector. The increased Mudra loan limit from Rs. 10 lakh to Rs. 20 lakh and the revised TReDS onboarding threshold will significantly benefit MSMEs.. Additionally, credit guarantee schemes and mechanisms for facilitating bank credit during stress periods are crucial steps forward. These measures will provide much-needed support, ensuring business continuity and fostering long-term growth. Notably, the ability to secure collateral-free term loans for machinery and equipment empowers MSMEs to invest in innovation and expansion. We are confident these initiatives will contribute significantly to the resurgence of the manufacturing sector.

Amar Nagaram, Founder and CEO, Virgio

Amar Nagaram, Founder and CEO, Virgio

“The Finance Minister’s budget theme, with its emphasis on Employment, Skilling, and MSMEs, showcases a forward-thinking approach that is well-suited to the evolving needs of the Manufacturing and D2C industries. This budget, aligned with the Viksit Bharat vision during the Amrit Kaal, introduces several key incentives aimed at boosting job creation and enhancing workforce skills. The special focus on MSMEs will provide critical support for innovation and expansion, facilitating growth across various sectors. Importantly, the abolishment of the Angel Tax will play a pivotal role in supporting startups, easing fundraising, and encouraging more investment in innovative businesses. Overall, this growth-oriented budget represents a significant step toward creating a more inclusive and dynamic economy, fostering opportunities for businesses and entrepreneurs alike.”