The industry welcomed the Union Budget 2022-23 presented by the Hon’ble Union Finance Minister Nirmala Sitharaman, which is encouraging, positive and growth-oriented.

We are covering reactions from the industry…

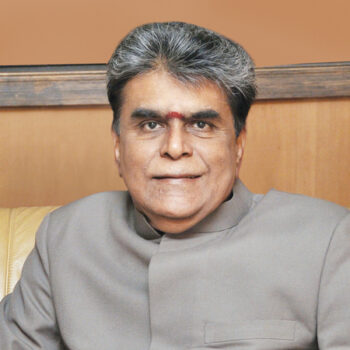

Raja. M. Shanmugham, President, Tiruppur Exporters Association (TEA)

Raja. M. Shanmugham, President, Tiruppur Exporters Association (TEA)

The Hon’ble Union Minister of Finance Nirmala Sitharaman presented Union Budget 2022-23. Raja. M. Shanmugham welcomed the Union Budget aimed to steer economy for next 25 years through PM Gati Shakti Seven engines of growth, Roads, Railways, Airports, Ports, Mass Transport, Waterways and Logistics Infrastructure for Economic Transformation, Seamless Multimodal Connectivity and Logistics Synergy and said the development of infrastructure will reduce the cost and beneficial to exporters.

While welcoming the Guarantee cover under ECLGS to be expanded by Rs 50,000 cr to total cover of Rs 5 lakh cr credit line till March 2023, Raja M. Shanmugham said this is the need of the hour to MSMEs like Tirupur Cluster and thanked the Hon’ble Minister for considering the requisition made by Association and also for revamping CGTMSE and beneficial to MSEs. He also welcomed the exemption provided on items such as embellishment, trimming, fasteners, buttons, zipper, lining material and packaging boxes, which will be beneficial to knitwear exporters.

While appreciating the review of Customs exemptions and Tariff simplification Raja. M. Shanmugham said combination of specific and ad-valorem rate is being replaced by ad-valorem rates only and the rate for the items placed under tariff items of 6101, 6102 or 6103 (import of Mens or Boys / Womens or Girls Overcoats, Cloaks, Wind-Cheaters, Wind–Jackets and Women Jacket, Ensamples etc.,) has been increased from 10 percent to 20 percent and this will protect the domestic garment business.

Raja. M. Shanmugham said for Amended Technology Fund Scheme (ATUFs), the allocated amount in the Current Union Budget is Rs. 650 cr as like last year and feels that the increased allocation is needed to clear the pending claims and he also pointed out that as the new scheme Textiles Technology Development Scheme is replacing ATUFs with an Capital Subsidy of 25 percent, against 15 percent in ATUFs, the requirement of amount is more.

Raja. M. Shanmugham lauded for the announcement on popularization of One Station One Product concept and said in due course of time, the transportation of domestic garments from Tirupur will increase through Rail transportation to reach the various destinations.

Ravi Sam, Chairman, The Southern India Mills’ Association (SIMA)

Ravi Sam, Chairman, The Southern India Mills’ Association (SIMA)

The Union Government has been constantly announcing several policies that are enabling India to attract large scale investments and alleviate unemployment problems. The Union Budget 2022-23 is yet another boon for India to become superpower in the coming decades.

Ravi Sam, Chairman, The Southern India Mills’ Association (SIMA) has said that the Union Government has already announced several unique schemes apart from boldly addressing certain structural issues on taxation front and raw material and substantially enhanced the global competitiveness of the Indian textiles and clothing industry, the second largest employment provider next only to the agriculture. He has hailed the various announcements made with regard to infrastructure development, productivity improvement, digital world and industry 4.0, skill development with hub & spoke model infrastructure facilities. It is heartening to note that the country is expected to grow at 9.27 percent in the coming year, a phenomenal achievement for any country in the post-COVID period, says Ravi Sam. He has said that GST collection of Rs.1,40,986 cr for the month of January 2022, the highest since the implementation of GST, is an indication for the phenomenal economic growth of the Nation. He has added that four pillars of development viz., inclusive development, productivity enhancement, energy transition and climate action would boost the overall economic growth of the Nation. Ravi Sam has welcomed the decision of extending Emergency Credit Loan Guarantee Scheme (ECLGS) till March 2023 to enable certain segments to gear up and achieve its potential growth.

SIMA Chairman has said that the allocation of Rs.17,683 cr to Cotton Corporation of India (CCI) to procure cotton for the years 2021-22 and 2022-23 under Minimum Support Price will help CCI to wipe out its losses incurred for procurement of over two cr bales of cotton during the last two years that had greatly benefited the farmers to sustain the area under cotton. He has said that the steep increase in the international cotton price and consequential domestic cotton price has made the Indian farmers to fetch huge revenue for their produce during the current season, though it has impacted the cotton textiles value chain exporters.

He also added that India has started achieving substantial growth rate both in the domestic and international cotton textiles & clothing market that is likely to fuel the cotton consumption by 15 percent to 20 percent during the current season resulting in shortage of cotton. He has hoped that the Union Government would consider the demand of exempting ELS cotton and sustainable cotton from the levy of 11 percent import duty as such speciality cotton is not produced in the country. He has also hoped that the Government would allow duty free import of cotton to the actual users with some quantitative restrictions for the off season, as the country is likely to face shortage of cotton to the tune of 40 lakhs bales. Considering the phenomenal growth of the industry and achieving the vision of doubling the textile business size in the next five years, it is essential for the Government to allocate necessary funds and announce Technology Mission on Cotton 2.0 on a war footing, says Ravi Sam.

Rajesh Masand, President, The Clothing Manufacturers Association of India (CMAI)

Rajesh Masand, President, The Clothing Manufacturers Association of India (CMAI)

President of The Clothing Manufacturers Association of India (CMAI) welcomed the Union Budget 2022 presented by the Hon’ble Finance Minister Nirmala Sitharaman, as a Growth oriented Budget which contains several measures which encourages Capital Expenditure and other Growth related activities.

Rajesh Masand said that the extension of the ECLG Scheme for MSMEs for one more year should also help the Apparel Industry, since many of the units in the Sector are still struggling to overcome the adverse effects of the Covid pandemic. However, it is unfortunate that the enhanced outlay for the Scheme is restricted only for the Hospitality Industry – as the Retail Industry was as badly impacted in the pandemic Hospitality. Even under the current wave, Retail continues to be impacted with lockdowns, partial closures, limited working hours, etc.

He also added that, one bright spark of the Budget specific for the Apparel Industry is the removal of Import Duty on Embellishments, Trimmings, Buttons, etc. this has been a long time demand of the Industry and should particularly help Apparel Exports to become more competitive. Whilst details are not yet available of the changes the Hon’ble Finance Minister is indicating for the SEZs, if significant, should also assist the Sector since several units in the SEZs are from the Apparel Sector. The incentives for new Manufacturing units should also benefit the Sector as this is closely aligned to the PLI Scheme.

Dr A Sakthivel, President, Federation of Indian Export Organisations (FIEO)

Dr A Sakthivel, President, Federation of Indian Export Organisations (FIEO)

Hailing the Union Budget 2022-23, Dr A Sakthivel, President, FIEO complimented the Finance Minister for a proactive, forward looking, all encompassing visionary budget. The budget has struck a fine balance to address the gap in social & physical infrastructure besides increasing digitization & new trends including digital Rupee and sovereign green bonds. The increase in the capital expenditure by 35.4 percent to Rs. 7.50 Lakh cr in 2022-23 from Rs. 5.54 Lakh cr in 2021-22 will enable MSMEs to benefit from additional capital allocation and boost job creation in the sector, opined FIEO Chief.

FIEO welcomed the extension of ECLGS Scheme for 2022-23 with an additional outlay of Rs 50,000 cr and allocation of an additional credit provision of Rs. 2 lakh cr under the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) to meet the requirement of MSMEs. The ECLGS Scheme has benefited the MSME during the peak covid time and its extension will further infuse life in the businesses, when recovery is on the card, said Dr Sakthivel. The CGTMSE will help to provide collateral free lending and infusion of liquidity.

The seven engines of growth under the PM Gati Shakti project will help to reduce the logistics cost and time of Indian exports significantly thereby imparting added competitiveness to exports. The setting up of 100 Cargo Terminals will facilitate Exim trade a lot as logistics challenges today are the biggest stumbling blocks. The focus on skilling through the “Digital Ecosystem for Skilling and Livelihood – the DESH Stack E-portal for Skilling, Re-skilling and Upskilling through online training will be very handy for exports as it will help in qualitative manufacturing and consistency in production.

Dr Sakthivel said that the replacement of SEZ Act with a new legislation to meet the requirement of a dynamic sector of international trade and transparent and risk based customs administration of SEZ will make SEZ an engine of economic growth and employment creation besides exports. He said that many other operational challenges faced by SEZ units including duty on the finished products while selling in the domestic market should be taken care of in the legislative changes. The extension of the time limit for concessional income tax facility of 15 percent to new domestic manufacturing units commencing production till 31st March, 2024 will attract investment particularly in various sectors of exports since the domestic investment is set to increase and global investment is likely to pour into the country including in joint venture opportunities.

The President, FIEO said that the sectoral relief given through the reduction in duty on cut & polished diamonds, gemstones, certain chemicals and extension of zero duty on steel scrap will benefit the gems & jewellery, chemicals and engineering exporters. Similarly, the restoration of the facility of duty free import of trimming and embellishments for exports will help the apparel, textiles, leather garments & leather footwear, handicrafts, sports goods and other sectors. The additional budget for the Interest Equalization Scheme for the year 2021-22 and provision of Rs. 2621.50 cr for 2022-23 have provided assurance on the continuance of the Interest Equalization Scheme and we are expecting a suitable announcement in this regard, said FIEO Chief.

President, FIEO appreciated the introduction of a new clause under the Customs Act making publishing of any information relating to the value or quantity or details of importer or exporter with imprisonment upto six months or with fine upto Rs. 50,000 or both, which will address the issue of revealing the sensitive information of exporters thereby generating unethical competition.

Narendra Goenka, Chairman, Apparel Export Promotion Council (AEPC)

Apparel Export Promotion Council (AEPC) Chairman Narendra Goenka welcomed the Union Budget 2022-23 presented by Hon’ble Finance Minister Nirmala Sitharaman stating that it’s a growth oriented budget, which will create opportunities for investments, exports and employment while simplifying the procedures. Goenka also appreciated the government for announcing a 35 percent increase in the capital expenditure to Rs 7.5 lakh cr for FY23 saying that it will accelerate overall growth of the economy through investments amid disruptions due to intermittent lockdowns. “I am extremely grateful to the Hon’ble Finance Minister for taking care of our liquidity requirements by extending credit linked guarantee scheme ECLGS by one year till March 2023 and by increasing the coverage by Rs 50,000 cr. Most of the apparel exporters are in the MSME category and many are still struggling with the impact of disruptions caused by Covid-19 pandemic,” Goenka said.

The Chairman was particularly thankful to the government for agreeing to the Council’s fervent appeal for reinstating duty free facility for importing trimmings and embellishments. “Trimmings and embellishments like fasteners, inlay cards, linings and interlinings, laces, etc that are used for branding and are nominated by the buyers were allowed duty free earlier. Most of the exporters import these items because of the buyers’ nomination and need to be sourced from defined sources within sharp timelines. Resumption of the facility will help apparel exporters make their products more internationally competitive. This is a big relief for small exporters,” Goenka said. The extension of the benefit of 15 percent tax for the newly incorporated manufacturing units by one more year to March 2024 will be instrumental in bringing in fresh investments, he said. He further stated that this would specifically help in bringing in new investment in the new units under Production Linked Incentive (PLI) scheme for MMF garments, MMF fabrics and technical textiles. “Besides, the plan to enact a new Special Economic Zones (SEZ) Act will be helpful in creating employment, increasing exports and investments,” the Chairman added.

T. Rajkumar, Chairman, Confederation of Indian Textile Industry (CITI)

T. Rajkumar, Chairman, Confederation of Indian Textile Industry (CITI)

T. Rajkumar welcomed the Union Budget 2022-23 presented by the Hon’ble Union Minister of Finance, Nirmala Sitharaman, in the Lok Sabha House of the Parliament. He said, “CITI hails the Union Budget 2022-23 which aims at inclusive growth of the New India and estimate India’s GDP growth at 9.2 percent which is highest among all large economies.”

T. Rajkumar while commenting on the budget allocation for the Textile Sector stated that for the year 2022-23, the budget allocation for the Textile Sector stands at about Rs.12,382.14 cr which is about 8.1 percent higher than the revised budget allocation of 2021-22 which stood at about Rs.11,449.32 cr. He further stated that the budget allocation during 2021-22 was initially Rs.3,631.64 cr. However, it was later revised to Rs.11,449.32 cr mainly due to an increased allocation for “Procurement of Cotton by Cotton Corporation of India (CCI) Ltd. under Price Support Scheme” from Rs.136 cr to Rs. 8,439.88 cr”. For the year 2022-23, the Government has allocated about Rs.9,243.09 for “Procurement of Cotton which is about 9.5 percent higher than the revised allocation of last year.

In the present budget allocation, the Government has allocated about Rs.133.83 cr for “Textile Cluster Development Scheme” hence the total budget allocation for “Research and Capacity Building” for Textiles has increased by 73.4 percent to reach about Rs.478.83 cr in 2022-23 as compared to the revised budget allocation of Rs.276.10 cr in 2021-22. He further stated that the recently announced Production Linked Incentive (PLI) Scheme and PM Mega Integrated Textile Region and Apparel (PM MITRA) Scheme also saw an allocation of Rs. 15 cr each for 2022-23. The Government has also allocated Rs.105 cr for the year 2022-23 towards “Raw Material Supply Scheme” which has already been approved for the implementation during the period 2021-22 to 2025-26.

CITI Chairman welcomed the PM Gati Shakti National Master Plan which encompasses the seven engines for economic transformation, seamless multimodal connectivity and logistics efficiency. The seven engines that drive PM GatiShakti are Roads, Railways, Airports, Ports, Mass Transport, Waterways and Logistics Infrastructure.

T. Rajkumar appreciated the steps taken by the Government for the extension of Emergency Credit Line Guarantee Scheme (ECLGS) up to March 2023. He further said that the guarantee cover under ECLGS will be expanded by Rs. 50,000 cr to total cover of Rs. 5 Lakh cr. Similarly, Rs. 2 lakh cr additional credit for Micro and Small Enterprises will be facilitated under the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE). The Government is also rolling out Raising and Accelerating MSME performance (RAMP) programme with outlay of Rs 6000 cr. All these steps will strengthen the MSME Segment which holds major share in the Textile & Clothing Sector.

CITI Chairman welcomed the decisions like “Amritkaal” the next phase of Ease of Doing Business (EODB) 2.0 and Ease of Living which will be launched by the Government shortly, an additional allocation of Rs.19,500 cr for Production Linked Incentive for manufacturing high efficiency solar modules to meet the goal of 280 GW of installed solar power by 2030. He said that such actions of the Government will be fruitful for the textile industry in the coming years.

T. Rajkumar also appreciated the decision of the Government for replacing Special Economic Zones Act with new legislation that will enable the States to become partner in the ‘Development of Enterprise and Service Hubs’. It will cover the existing industrial enclaves and enhance the competitiveness of our textile exports.

CITI Chairman welcomed the move to incentivise exports. He said exemptions on items such as embellishment, trimming, fasteners, buttons, zipper, lining material, specified leather, furniture fittings and packaging boxes will help the textile sector.

T. Rajkumar stated that gradually phasing out of the concessional rates in capital goods and project imports and applying a moderate tariff of 7.5 percent which is conducive to the growth of domestic sector and ‘Make in India’ is a welcome step. He further stated that the certain exemptions for advanced machineries that are not manufactured within the country shall continue and help the textile sector as Indian textile sector depends on state-of-the-art textile machineries.

CITI Chairman concluded by saying that though, the current Union Budget doesn’t make any direct announcement for the textile and clothing sector, however, if we see the entire budget speech in totality, it talks more about the inclusive development of the new India. The Government has already gone beyond a level and has done so much for the textile sector. It is now for India Inc. to look for developing at other important aspects of the businesses like infrastructure development, liquidity, labour and power issues, availability of raw materials, ease of doing business, FTAs, technology transfer, etc to enhance the cost competitiveness of Indian products in the global market.

Manoj Patodia, Chairman, The Cotton Textiles Export Promotion Council (TEXPROCIL)

Manoj Patodia, Chairman, The Cotton Textiles Export Promotion Council (TEXPROCIL)

“Union Budget 2021-22 Growth oriented but imposition of BCD on Cotton – a matter of deep concern” – Chairman, TEXPROCIL The Union Budget for 2021-22 has launched “Mega Investment Textiles Parks (MITRA) under which seven Textile Parks will be established over a period of three years. “This is a very positive step which will enable the textile industry to become globally competitive, attract large investments and boost employment generation”, said Manoj Patodia.

The Budget has reduced the Basic Customs Duty on caprolactam, nylon chips and nylon fibre & yarn to 5 percent. This will encourage the growth of the MMF sector especially the MSMEs, according to the Chairman. On the Direct Taxes, the Budget has reduced the time-limit for re-opening of assessment to 3 years from the present 6 year. This is a welcome step and it will remove the uncertainty for the assesses”. However, Manoj Patodia expressed his concern over the imposition of 10 percent Basic Customs duty on Raw Cotton which was surprising.

He said this will make imports of Extra Long Staple Cotton costly especially Giza Cotton from Egypt and Supima Cotton from the US. The Chairman also expressed his apprehension that the imposition of import duty on Cotton will increase the domestic prices of Cotton which will now be based on the import parity price plus the Basic Customs duty which in turn will increase cost for the value added products like fabrics , made ups and garments. He also pointed out that there has been a decline in imports of cotton by a sharp 77 percent during the period from January to Novembers 2020 as compared to the same period in 2019 and as such there is no case for an imposition of import duty on cotton.

Manoj Patodia appealed to the Government to withdraw the Basic Customs duty on Cotton in the interest of the textile & clothing sector and its orderly development and especially as India is a cotton surplus country. He further stated that if the Basic Customs duty on Cotton is not withdrawn immediately it will have an adverse impact on employment and investments in the value added textile & clothing sector.

Dhiraj R. Shah, Chairman, The Synthetic & Rayon Textiles Export Promotion Council (SRTEPC)

Dhiraj R. Shah, Chairman, The Synthetic & Rayon Textiles Export Promotion Council (SRTEPC)

Hon’ble Union Finance Minister Nirmala Sitharaman presented the Budget 2022-23 focusing on 4 pillars of the Indian economy, viz., manufacturing productivity, financing investments, climate action and PM Gati Shakti plan. Dhiraj R. Shah, Chairman, SRTEPC congratulated Hon’ble Prime Minister Narendra Modi, and Hon’ble Union Finance Minister Nirmala Sitharaman for presenting the Budget which is a growth-oriented and futuristic.

The Budget has signaled increased allocation for the textile sector by 8.1 percent increase in FY23 compared with the revised budget allocation for FY22. According to the Union Budget presented recently, of the total allocation of Rs. 12,382 cr for the textile sector for next financial year, Rs.133.83 cr is for Textile Cluster Development Scheme, Rs. 100 cr for National Technical Textiles Mission, and Rs. 15 cr each for PM Mega Integrated Textile Region and Apparel parks scheme and the Production Linked Incentive (PLI) Scheme. Dhiraj R. Shah, Chairman, SRTEPC informed that increased budget allocation for the textiles sector will help in growth of the industry and technological advancement.

The Centre has also allocated Rs.105 cr for FY23 towards the Raw Material Supply Scheme. Moreover, trimmings, embellishments, labels etc. which were subject to 5 percent import duty will now be available as duty-free imports for exporters of textiles. This is going to boost our exports of value-added items like made-ups, etc. Dhiraj R. Shah, added.

He also informed that, at present, machinery such as for knitting and weaving machines are included in the list of machines having Concessional Custom Duty of 5 percent. All these machines will attract 7.5 percent import duty. This will encourage the textile engineering segment to manufacture more state-of-the art textile machineries within the country in line with the “Make in India”, Atmanirbhar Bhart, initiatives of the government.

The Budget has also mentioned on the review of customs exemptions and tariff simplification for certain items including fabrics. “This comprehensive review will simplify the customs rates and tariff structure particular for sectors like chemicals, textiles and metals, and minimise disputes,” she said.

The rationalization of the Customs duty that includes the ad valorem tax and specific duty will be helpful for industry in the long term, SRTEPC Chairman mentioned. Some of the major issues mentioned during the Budget are the following:

New regulations to replace the Special Economic Zones Act for the development of enterprise and hubs. It will cover the existing industrial enclaves and enhance the competitiveness of exports. The Emergency Credit Line Guarantee which has provided additional credit to MSMEs, extended till March 2023. Guarantee cover to be expanded by Rs.50,000 cr to a total cover of Rs. 5 lakh cr. Additional amount earmarked exclusively for hospitality-related sectors. With 1486 Union Laws repealed, Ease of Doing Business 2.0 will be launched. Allowing surcharge on all capital gain on all assets which have been brought down to 15 percent.

The Budget stepped up the capital expenditure sharply by 35.4 percent to Rs 7.50 lakh cr to attract more private investment and attract growth. For 2022-23, allocation of Rs 1 lakh cr is announced to assist the states in catalyzing overall investments in economy.

Dr. S N Modani, CEO & Managing Director, Sangam India Ltd

Dr. S N Modani, CEO & Managing Director, Sangam India Ltd

The Union Budget 2022 presented by the Honorable FM Nirmala Sitharam is paving way for excellent growth in the times to come. The government has given clear indication that the budget is more growth-oriented wherein the capital expenditure of the Central Govt. will be to the tune of Rs. 10.68 lakh cr for 2022-23 which is 4.1 percent of the GDP. The budget puts immense thrust in manufacturing and capital expenditure which should enable the economy to grow and achieve its target of being a $ 5 trillion economy by 2025.

The positive initiative taken towards green power and the allocation of Rs. 19500 cr for manufacturing of additional solar panels to meet the requirement of solar power in multiple sectors is noteworthy. The highest GST collection for the month of January 2022 shows that the Indian economy will face a robust growth. Even the figure of $635 trillion forex reserve signifies the economic strength of the nation on the export front. All put together, this Union Budget is very promising; growth oriented and will also be able to address the concerns of unemployment.”

Vinod Kumar Gupta, MD, Dollar Industries Limited

Vinod Kumar Gupta, MD, Dollar Industries Limited

The Government has once again ensured trust-based governance to build Atmanirbhar Bharat by extending the The Emergency Credit Line Guarantee Scheme (ECLGS) till March 2023. We welcome the move of extending the ECLGS scheme which will be beneficial for the MSMEs. Significantly, several textile and hosiery players belong to the MSME sector. On the other hand, the credit and fiscal support of 5 lakh cr will give a huge boost to this sector encouraging new businesses to come to the fore. Besides, the announcement will certainly generate more than 10 lakh of employment opportunities in a short span of time.

The proposal of 350 exemption entries to be gradually phased out is a significant move. These include exemption on certain agricultural produce, chemicals, fabrics, medical devices and drugs and medicines for which sufficient domestic capacity exists. We are hopeful that this is likely to benefit the textile industry.

The government has reposed its faith in taxpayers, entrepreneurs, investors, enabling it to build an open, digital and inclusive India with a 25-year vision. As there has been no reduction/relief on the personal taxation side, however, the good part is that we did not see levy of any additional tax.

Nivedan Churiwal, Managing Director, BSL Ltd

Nivedan Churiwal, Managing Director, BSL Ltd

“The Finance Minister presented a positive and growth-oriented budget which was overall on expected lines. No major tinkering has been done and major impetus has been given to the startups and reduction in taxation on digital assets is also a step in the right direction. The budget has tried to encompass all segments of the society with a focus on rural housing, MSP direct payments and Rs. 2.00 trillion outlays for MSME. The Gati Shakti master plan will give a massive boost to the rail and road network in the connectivity in the country. Overall, the Government is taking the economy ahead in the right direction.”

Aarti Jhunjhunwala, Executive Director, Fineotex Chemical Limited

Aarti Jhunjhunwala, Executive Director, Fineotex Chemical Limited

“India’s GDP is projected to grow at a historic high of 9.2 percent in FY2022. The chemical sector being one of the leading contributors to the economy has the potential to significantly help India to catapult its economy to become $5T by 2025.

The specialty chemical industry being a niche segment will see a steady growth over the next few years driven by increase in domestic consumption and demand from foreign markets. The growth will further the goal of achieving GOI’s policies such as ‘Atmanirbhar Bharat’, and ‘Make in India’.

The Budget 2022 has provided for the comprehensive review to simplify the Customs rate and tariff structure particularly for sectors like chemicals, textiles and metals and minimise disputes. This is a welcome move. Removal of exemption on items which are or can be manufactured in India and providing concessional duties on raw material that go into manufacturing of intermediate products will go many a big step forward.

With Budget 2022 laying greater emphasis on green energy and sustainable development, ESG related certifications amongst industries will definitely focus. Since we are already at the forefront of the sustainability led activities, FCL will be able to capitalize on the same.

The Budget 2022 has also announced the extension of Production Linked Incentives (PLI) Schemes to additional sectors including the textile sector. This will further boost capacities in the textile segment and thus will help the associated industries like speciality chemicals segment, to increase their capacities.”

Sanjay Jain, Chief Executive Officer, PDS Limited

Sanjay Jain, Chief Executive Officer, PDS Limited

The retail and textile industry has been keeping a close eye on the Union Budget to propel them out of the pandemic’s afflictions. The recently announced Production Linked Incentive (PLI) scheme for textiles, with an approved outlay of Rs. 10,683 cr for five years signifies a great step forward for the industry. Although there has been a 41 percent increase in textile exports from April-December 2021 against last year, the measures taken can further help the sector to be more competitive with global economies.

Additionally, the exemptions allowed on imports based on export performance in handicrafts, garments, and leather will work well for the industry. India’s textile industry must aim for $65 bn in exports in the next five years, especially with the “China Plus One” sentiments providing India a commendable position as global companies look at sourcing and manufacturing destinations outside of China.”

Abhishek Pathak, Founder & CEO, Greenwear

Abhishek Pathak, Founder & CEO, Greenwear

The budget for the year 2022-23 has provided a promising start for a greener and cleaner future of our economy. Sovereign Green bonds for mobilising resources for green infrastructure will definitely add value in reducing the carbon intensity of the economy. It would have been an icing on the cake if the budget allocation in the clean energy sector would somehow be directly linked with livelihood generation at the local level.

Announcement of Vibrant Village Programme and inclusion of decentralised renewable energy resources for villages located on the Northern border is also a welcoming step. There is not much for the traditional textile industry. However, the budget incentivises textile exports by exempting various embellishments which might help bonafide exporters indirectly working with traditional crafts.”