After the deal with Mauritius comes the comprehensive economic cooperation agreement (CECA) with the United Arab Emirates (NAE). India has paused talks for free trade treaties for almost a decade with all other countries. This marks a significant change in New Delhi’s stance as it wants to shed its inhibitions after its exit from the Regional Comprehensive Economic Partnership (RCEP) due to the overarching presence of China.

After the deal with Mauritius comes the comprehensive economic cooperation agreement (CECA) with the United Arab Emirates (NAE). India has paused talks for free trade treaties for almost a decade with all other countries. This marks a significant change in New Delhi’s stance as it wants to shed its inhibitions after its exit from the Regional Comprehensive Economic Partnership (RCEP) due to the overarching presence of China.

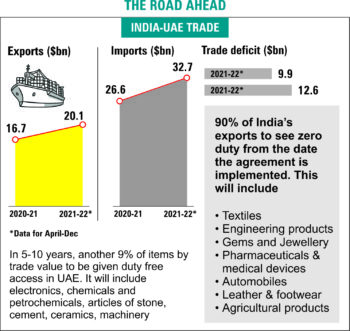

The CEPA with the UAE has several firsts to its credit. It allows almost 90 percent of India’s exports duty free. Textiles and apparel products are among them. A safeguard mechanism has been put in place to check any misuse of the treaty by way of a surge in imports. Bilateral trade is expected to touch $100 bn in the next 5 years. The UAE will be the gateway to Africa and other Gulf countries, and even East Africa, while India is the gateway to the whole of Asia. The UAE is part of the Gulf Cooperation Council (GCC). Finally, the deal was struck in a record time of 88 days.

The UAE is set to emerge as India’s third trading partner after the US and China. The India-UAE trade stood at $39.7 bn in April-October 2021, up to which the latest data is available. Exports valued at $24.3 bn resulted in a trade deficit of $8.5 bn. During the same period, India’s trade with the US stood at $67.4 bn and that with China at $65.7 bn. According to Commerce and Industry Minister Piyush Goyal, the FTA with the UAE will give a major boost to several sectors, including textiles. Thani bin Ahmed Al Zeyoudi, UAE’s Minister for Foreign trade (who was a member of the negotiating team), feels that the FTA with the Emirates will open the doors to many other countries for Indian exporters and will bring in investment as the overall climate has completely changed. This will have a huge impact on exports, re-exports, and imports.

Among the textile products, apparel is the largest item exported to the UAE. In the last 5 years, India’s share of the UAE’s total textile and apparel imports has come down with duty free tariffs. India can cater to the hospital segment through institutional selling of home textiles like bed and bath linen as well as contract textiles like beach towels, salon and spa linen etc., According to CITI estimates, an additional increase in textile exports is expected to reach $2.25 bn over the next 5 years.

Besides, schemes like production linked incentive (PLI) and PM Mega Integrated Textile Regions will enhance India’s export competitiveness of textiles and apparel items and will enable it to increase exports of these products. In addition, the deal is likely to benefit about $26 mn worth of Indian products that are subjected to 5 percent import duty in the UAE. The trade pact includes key provisions for easier movement of Indian professionals and workers to the emirates.

Meanwhile, the Russia-Ukraine war is casting a shadow on the garment exports from Tirupur in Tamil Nadu. Annual exports to Russia, Ukraine, and its neighbouring countries through the European Union amount to around Rs. 500 cr. The exporting community is tense over the situation. According to Tirupur Exporters Association (TEA) President Raja Shanmugham, nearly 40 percent of the region’s export business is with the EU and the UK, with a monthly turnover of Rs.1200 cr. Most European buyers and brands have branches or franchises set up in Russia. No estimate is available on the quantum of garments sent by European buyers to Russia and Ukraine. Rhythm Knit India, which manufactures children’s garments, exported Rs. 5 cr worth to the Russian market. Best Corporation has business of Rs. 15 cr a month with the EU, a small portion of which may be destined for Russia.

Though the current export quantum of Tirupur garments is minuscule, companies which had plans to expand there have been put on hold now, affecting their long-term business. Due to several issues, including payment guarantees from Russian buyers, exports have come to a halt, reports say. The ongoing crisis may slow down purchases by the EU. European buyers will be forced to cut expenditure, leading to a price escalation of raw materials and finished goods. The textile industry in Tamil Nadu is most likely to take a hit due to the war situation.

Apart from the Russian-Ukranian conflict, the crisis in the neighbouring island nation of Sri Lanka is likely to benefit Tirupur apparel exporters. They hope to grab around 5–10 percent of the business from the apparel makers in Sri Lanka. According to Raja Shanmugham, global brands may divert some of their orders to the Tirupur District from Lanka.

The crisis is escalating day by day. Several industrial units have closed their shutters due to fuel shortages and frequent power cuts. The same brands are placing orders in India, Lanka, Vietnam, and Bangladesh. This may come as a blessing in disguise to Tirupur exporters. There are no concrete inquiries from the global brands, though the chances of them striking more business deals with the exporters are high.

The island nation, reports say, exported apparel valued at Rs.212.45 cr and Rs.60 cr to the US and UK, respectively, in 2021. Total garment exports were worth Rs. 541.59 cr last fiscal. The Tirupur units have been reeling under the yarn price hike for some time. The price of yarn is higher than in Bangladesh and Vietnam.

Unlike Tirupur, Sri Lankans use high-end yarn to make inner garments. Lanka employs a lace-type yarn made entirely of polyester. In Tirupur, exporters use 20 to 10 count yarn. Units that produce inner wear and intimate garments in bulk in the district have a chance to bag orders that were going into the island nation.