Has not the time come for the Indian spinning sector to expand and convert all available cotton into (cotton) yarn, instead of exporting a part of it as fibre to our competitors? This question comes uppermost in our minds in the context of the obligation imposed on spinners to pack, in hank form 40 per cent of cotton yarn to ensure availability to the de-centralised handloom sector of the textile industry. It is known that cotton yarn, a value-added product, earns more foreign exchange than cotton, a natural fibre.

The hank yarn obligation comes under the Hank Yarn Packing Obligation introduced way back in 1974. The obligation, pegged at 50 per cent, was scaled down to 40 per cent in 2003, after a lapse of 29 years. Originally, the obligation covered cotton and viscose yarn, but is now applicable only to cotton yarn, since viscose yarn was got removed from the Essential Commodities Act.

Another about 15 years have gone by there are demands for further reducing the obligation level to 15 per cent in the first phase for a period of six months and review the position after six months. The reason advanced by Chairman of Confederation of Indian Textile Industry Sanjay K Jain is that the fall in demand for hank yarn has led to a sharp increase in the hank yarn obligation premium – currently ruling around Rs. 3 kg –and that no such obligation is available in the market to fulfil the obligation. Another reason is that the steep increase in the hank yarn premium would raise the price of cone yarn and affect the ailing powerloom sector.

Why the obligation is still being continued? Does it serve the purpose for which it was meant? The lack of reliable data has compounded the issue with no definite conclusion that it has helped improved handlooms working on productivity. The actual requirement of yarn for the handloom sector is difficult to assess on the basis of handloom fabrics production. Surprisingly enough, many handlooms find it convenient and profitable to use cone yarn. In this regard, the recommendations of the Sathyam Committee (set up by the government) which examined all issues in the textile sector in detail found the hank yarn obligation “irrational” and recommended more viable alternatives that could actually ensure adequate availability of yarn for the handloom sector. But these recommendations are yet to be accepted and implemented.

On the hank yarn obligation, the government claims that with the strict enforcement of the Hank Yarn Packing Notification issued by the Textile Commissioner, Mumbai, it is ensured that actual packing of hank yarn is sufficient to meet the total requirement of hank yarn in the country. Despite the government’s, claims, hank yarn gets diverted to the powerloom sector. This takes place though that action invites lodging of FIRs against defaulting mills by Textile Commissioner’s office.

The objective of the hank yarn obligation is to protect the handloom sector. In actual fact, weavers have been adversely affected as they are treated as labourers by master weavers (also called agents). Monies meant for weavers get diverted to these agents. This has accentuated the plight weavers who are paid low wages. The only consolation is that they get their insurance amounts without any problem. It must be ensured that government allocations reach weavers for whom they are meant. At the same time, it is known that operations in the handloom sector have become unviable. So, the alternative is to retrain these weavers and shift them to the powerloom sector or any other sector. India’s textile and clothing industry is one of the mainstays of the national economy. It is also one of the largest contributing sectors of India’s exports worldwide. The report of the working group set-up by the Planning Commission on boosting manufacturing exports during the 12th Plan envisages exports of textiles and clothing at $32.35 bn by the end of the 11th Plan as against $55 bn envisaged in the report of the working group on textiles for the 11th plan.

Based on the historic growth rate of 10 per cent a business as usual approach, will result in exports of $52 bn by the end of the 11th plan and creation of 25 mn additional jobs has been proposed with a compound annual growth rate (CAGR) of 15 per cent during the 12th Plan. The industry accounts for 14 per cent of industrial production, which is 4 per cent of GDP, employs 35 mn people and accounts for nearly 12 per cent of the country’s exports.

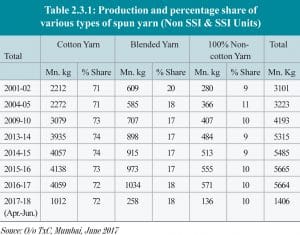

As per the provisional estimates, spun yarn production was marginally down in 2016-17 over 2015-16. During 2016-17, total spun yarn production was lower by one mn kg. In percentage terms, total spun yarn production was almost stagnant during this period. Production of cotton yarn, blended yarn and hundred per cent non-cotton spun yarn was 4,059 mn kg, 1,034 mn kg and 571 mn kg respectively during 2016-17. Provisional data shows that cotton yarn production had declined by 79 mn kg, while blended yarn production had increased by 62 mn kg and hundred per cent non-cotton yarn had increased by 16 mn.

Kg in 2016-17 over the previous year

The progressive growth of spun yarn had registered some momentum till 2009-10. However, in the subsequent years there was a wide divergence between cotton yarn growth and blend and hundred per cent non-cotton yarn. This divergence in growth became more pronounced during 2015-16 and 2016-17. It can be concluded that cotton yarn growth in the last 17 years had decelerated into the negative zone while blend spun yarn production moved up significantly. During the same period, non-cotton yarn production growth was positive though the pace of growth slowed down, showing laxity in production.

In order to face global competition, the textile industry needs to operate in a business environment to help reduce costs and respond to global demands in the most effective way. More than ever before, faced with the challenge of keeping the country on the map for buyers, textiles and clothing companies need to improve their competitiveness by focusing on the general business environment in which their factories operate and keep on adopting new technologies.

To conclude, the hank yarn obligation, found to be a major irritant for the spinning sector, should be scaled down to 15 per cent, bowing to demands or rescinded altogether.