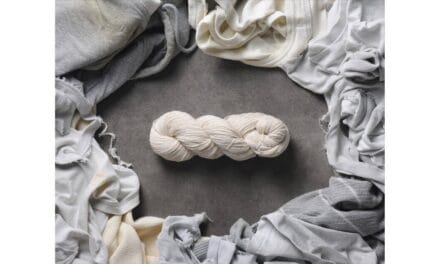

Bangladesh’s non-cotton apparel exports have the potential to surge to $42 billion by 2032 through developing a comprehensive value chain and reducing reliance on imports with an additional investment of $18 billion, according to a study. The country’s current non-cotton apparel export is valued at $15.6 billion, which is lower than cotton apparel exports, although it is increasing rapidly in the global trade, said the study titled “Beyond Cotton: A Strategic Blueprint for Fibre Diversification.”

Bangladesh’s non-cotton apparel exports have the potential to surge to $42 billion by 2032 through developing a comprehensive value chain and reducing reliance on imports with an additional investment of $18 billion, according to a study. The country’s current non-cotton apparel export is valued at $15.6 billion, which is lower than cotton apparel exports, although it is increasing rapidly in the global trade, said the study titled “Beyond Cotton: A Strategic Blueprint for Fibre Diversification.”

The Bangladesh Garment Manufacturers and Exporters Association (BGMEA), which conducted the study with the support of Indian research firm Wazir Advisors Pvt Ltd, unveiled it at a press conference held at its headquarters at Uttara in the city. Over the past five years, there has been a notable surge in global non-cotton fibre production, accounting for 78% share of the total fibre production, the study mentioned, saying that in contrast, cotton fibre production has faced a decline during the same period.

The study found that Bangladesh’s cotton apparel exports exhibited a high concentration, primarily focusing on four categories including t-shirts, jerseys, and woven trousers that collectively command a significant 63% share. As Bangladesh approaches graduation from the least developed country status in 2026 and the government and industry leaders are negotiating to extend the duty-free market access to the global market up to 2032, the country should aim to achieve a sustained double-digit growth rate in non-cotton apparel exports, aspiring to increase the earnings to $42billion, it said.

To realise the vision, the report recommended developing a dedicated policy for the non-cotton industry, encompassing a clearly defined vision, mission, and actionable points that specifically address the key challenges of insufficient technical know-how and limited upstream capacities. It also estimated that an investment of approximately $18 billion in the area of yarn, fabric and garment manufacturing will be required to forge a fully integrated value chain that aligns with the aspirations set for the vision 2032.

Of the investment, $ 4.6 billion will be required for fibre, filament and yarn manufacturing, $9.2bn for fabrics manufacturing and $4.2bn for apparel manufacturing with $0.5 million for sewing machines, the report said. The new investment will create additional employment of over 18 lakh, it said. The report also identified lack of technical know-how and limited upstream capacities as the key challenges for establishing a non-cotton value chain in Bangladesh.

Varun Vaid, Business Director of Wazir Advisors Pvt Ltd, presented the key findings of the study at the press conference. He pointed out the global trend of using non-cotton fibres, which accounts for 75% of garment production, while in stark contrast, Bangladesh’s local apparel makers primarily utilise cotton fibres, at a rate of 71%. Talking with Varun Vaid said if the country can create a comprehensive value chain for non-cotton apparel that will be helpful to increase its share to 40% by 2032.

BGMEA President Faruque Hassan said, “We want to take the global market share of locally-made apparel to 12% from the existing 7.87% through using the non-cotton fibre as the prices of the products made with man-made fibre were higher than the cotton-made items.” The choice of consumers has also been changed and they prefer durable and sustainable products, he said.

Faruque Hassan said a concept that Bangladesh mainly produced basic garment items is not true anymore as the country now produces high-value items like jackets, with per-unit prices exceeding $100.

The BGMEA president said the use of non-cotton fibre in garment production in Bangladesh increased to 29% from 25% over the last three years.

Diversification of fibre does not mean the production base is shifted from cotton fibre. The local garment exporters are making cotton garments and they can increase the volume of non-cotton garments to grab more markets at better prices, said Faruque Hassan.

The BGMEA President said following the LDC graduation the government could not provide cash incentives for the sector but the government incentive would be needed in different forms in establishing a non-cotton value chain in the country.

Regarding the recent price hike of power, Faruque Hassan said it would increase the cost of production, fuel inflation and hamper the growth of the apparel sector. He urged the government to withdraw the electricity price hike decision. Bangladesh’s apparel exports reached $46.99 billion in fiscal year 2022-23, according to Export Promotion Bureau data.