Sportswear industry is a lucrative sector for business. The global sportswear market is predicted to reach $184.6 bn by 2020. This industry has grown and is predicted to continue its growth at a GAGR of 4.3 per cent (2015-2020).

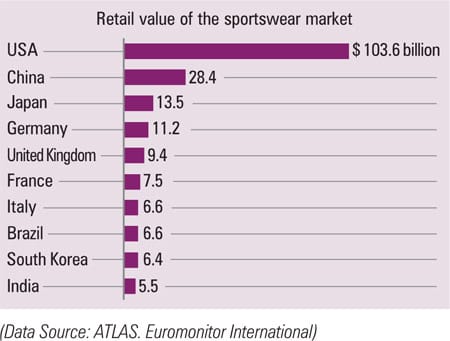

The major global players in sportswear apparel segment are Nike Inc., Adidas, Ralph Lauren Corporation, Umbro Ltd., Fila Inc., Lululemon Athletica Incorporation, New Balance Athletic Shoe Inc., Columbia Sportswear Company, etc. Retail value of the Sportswear Market (2016) is given in table.

Factors affecting sportswear business

Rising demand

Sportswear was traditionally used by consumers during workout sessions or while playing sports. The comfort factor and agility associated with sportswear apparel has taken it ahead into casual wear segments also. Growing health awareness and consumer interest in fitness, in addition to growing female participation in fitness and sports activities, has further led to rise in the attractiveness of this industry.

“Different fashionable garment types now include gymnastic outfits, casual sportswear, youth-oriented casual wear, fitness clothing and sportswear, performance sportswear, commercially available sportswear, technical sportswear garments, and exclusively manufactured tracksuits. Since 1979, the term “athleisure” has been coined for clothes that are designed to be “worn both for exercising and for doing (almost) everything else” (Merriam Webster 2015. “Words We’re Watching: Athleisure” Accessed July 14, 2016.)

Geographical Dominance

Till 2014, North America was the biggest revenue-generating market for global sportswear sales, however, by 2020; Asia-Pacific is expected to become the leading revenue generator in the sportswear segment, owing to the growing disposable incomes and living standards in countries like India and China. The biggest challenge although, for the industry is countering sales of counterfeit products in these countries.

Mode-of-sale

Sportswear market is mainly segmented into online and brickand- mortar retail stores. Brick-and-mortar retail sector is still the biggest mode-of-sale in this market. Favourable demographics and growing inclination for trendy designs are further boosting the market growth. Multiple brands are now focusing on setting up company-owned and retail stores to increase their sales. Online mode of sale is although set to become the future of this industry, owing to the vast penetration of internet and high availability of online discounts.

Growing disposable incomes

Over the past few years, disposable incomes in major global economies have increased. As per the National Bureau of Statistics of China, the annual per capita disposable income in China (urban households) has increased from $2,818.6 in 2010 to $4,692.9 in 2014. A similar trajectory can be seen with disposable incomes in India; $1,336.2 bn in 2010, to $1,587.6 bn in 2013. Also, in the USA, the per capita annual disposable personal incomes have grown from $37,807 in 2011 to $41,099 in 2014. This growth is one of the major factors that catalyze the growth of sportswear market globally.

Innovation

Sportswear demand depends upon the product’s performance, trend, sustainability, and innovation. Sportswear innovation has taken the industry far ahead of simply selling apparel and accessories to selling technological solutions for the athletes. For example, Under Armour sells lightweight shirts that can keep muscles warm, and plans to sell sneakers that can lace themselves. They further plan to connect their sneakers directly to the wearer’s phones for real-time tracking. Nike is working on body sensors in its apparel, which can sense and monitor movement and stream the stats directly to the consumer’s phones.

Why invest in sportswear industry?

Sportswear is becoming the first pick for almost all the leading brands now. An uncertain business environment is forcing businesses to look for stable and predictable investment grounds. Sportswear business has been around since the 1920s and is still growing in popularity.

Sportswear brands also enjoy an extremely loyal customer base, as the decision making is primarily based on the apparel’s performance rather than cost. Moreover, rising millennial customers, booming middle class, increasing fitness consciousness, various government investments for development of local industry (especially in developing economies), and rapidly growing appetite of consumers for sportswear, particularly for global brands are the factors that make this industry exceptionally lucrative for investments.

Future of the industry

In Asian countries, economic growth is acting like a rising tide that is lifting all the boats. For instance, Nike recorded a growth of around 9.5 per cent in 2016 in China, while Adidas’s sale jumped in the country by 22 per cent through 2016.

“We believe we’ve just scratched the surface of our growth potential in this important market,” said Mark Parker, CEO of Nike to investors regarding Chinese sportswear market. Also, with innovation pacing the industry, sportswear is predicted to be conceived much more than simply apparel in the future. Builtin motion sensors, temperature trackers, etc. are going to change how customers view sportswear altogether.

“If you have one product that you could wear in the snow and in the blazing hot sun so that you are always comfortable, why would you have another product?,” says Kevin Haley, Under Armour’s Head of Innovation.

The innovation in sportswear is not limited to performance apparel, but also extends to textiles. MIT’s Tangible Media Group is working on a project called ‘Bio-Skin’, to create an organic material that can respond to wearer’s body heat and perspiration. Thus, the industry is moving on a growth trajectory, and innovation is garnering much more attraction from customers in the segment.