Global markets, including the US seem to be picking up, raising hopes of a in a substantial growth in India’s Textile and apparel exporting during the current year (2022) In the last two years (2021 and 2020) these exports saw a huge decline due to be bruising impact of the corona virus pandemic limiting purchases by our major buyers. Now, there is an effort to replenish pipeline stocks.

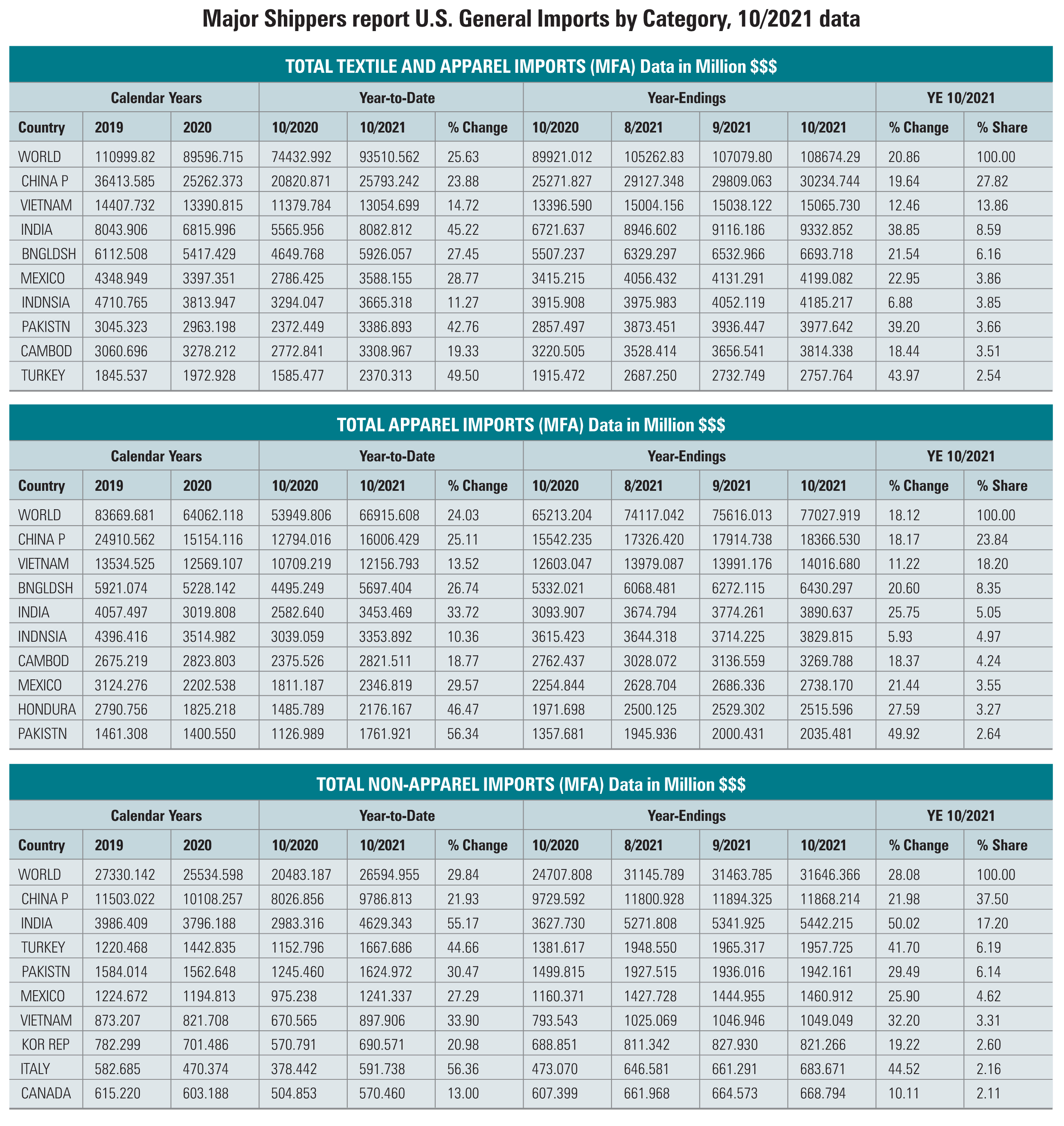

That the recovery in exports compared to 2020 and 2019 is in sight is evident from the latest data completed by the office of the US Textile Department. Take apparel, the most important item in the export basket. India’s exports have posted on impressive 33.72 percent growth during January – October 2021 over the same period of the preceding year. In value terms exports have risen from $2582.64 mn to 3453.46 mn. India has overtaken China whose exports posted an increase of 25.11 percent, from $12794.21 mn to $16006.4 mn during the period in question. Even Vietnam’s exports were lower than those of India, from $10709.21 mn to $12156.79 mn recording a growth of 12.52 percent. Vietnam, India’s major competitor has more facilities than this country has. On the other hand, exports from Maxico, which is covered by the North American Free Trade Agreement (NAFTA) reported a 29.57 percent increase from $1811.18 mn to $23.46.81 mn. India’s neighbour, Bangladesh, whose mainstay is apparel exports, could register a growth of 26.74 percent, though volume – wise, these exports have been larger than those of India.

That the recovery in exports compared to 2020 and 2019 is in sight is evident from the latest data completed by the office of the US Textile Department. Take apparel, the most important item in the export basket. India’s exports have posted on impressive 33.72 percent growth during January – October 2021 over the same period of the preceding year. In value terms exports have risen from $2582.64 mn to 3453.46 mn. India has overtaken China whose exports posted an increase of 25.11 percent, from $12794.21 mn to $16006.4 mn during the period in question. Even Vietnam’s exports were lower than those of India, from $10709.21 mn to $12156.79 mn recording a growth of 12.52 percent. Vietnam, India’s major competitor has more facilities than this country has. On the other hand, exports from Maxico, which is covered by the North American Free Trade Agreement (NAFTA) reported a 29.57 percent increase from $1811.18 mn to $23.46.81 mn. India’s neighbour, Bangladesh, whose mainstay is apparel exports, could register a growth of 26.74 percent, though volume – wise, these exports have been larger than those of India.

As regards, non apparel, which consists of yarn, fabrics and made-ups. India notched up a 55.17 percent growth, again overtaking China which could record an increase of 21.93 percent during the period under review. Vietnam posted a growth of 33.90 percent and Maxico achieved on increase of 27.29 percent. Total imports of these products by all countries, into the US were up 29.84 percent. Thus, India’s total textile and apparel exports to the US recorded a 45.22 percent increase, highest compared to other countries. China’s exports rose by 23.88 percent. Bangladesh posted a growth of 27.45 percent and Mexico achieved an increase of 28.77 percent.

It needs has mention that the US again is an important destination for India’s textiles and apparel exports. India is the third largest supplier of apparel and textiles products to the US after China and Vietnam.

Washington is responsive to providing preferential access for Indian goods under the generalised system of preferences (GSP) as and when the legislation is in place. While it may not have any major effect on India’s textiles and apparel exports, it could help corner same of the space vacated by Chinese products.

For textiles, nearly 99 percent of products are not covered by GSP. The remaining one percent coverage have Most- Favoured – Nation (MFN) duties (normal duties) of just 2-3 percent. Thus the US withdrawal of GSP is a non-issue. Further, an analysis of the situation by the Federation of Indian Export Organisations (FIEO) reveals that the duty advantage under GSP is on 5111 items out of 18770 tariff lines. For over 2110 items the advantage is 4 percent or less. Exports with over 3 percent duty preference are likely to be affected.

On American concern that India’s tariffs are quite high, trade experts say that the average applied tariffs are much below the bound rates that were negotiated at the time of the formation of WTO. The bound rates have factored in the development status and allowed for adequate protection. The average import duty charged by India is 13.8 percent compared to US 34 percent, 13.7 percent, each by Argentina and South Korea, 13.4 percent by Brazil and 10.8 percent by Turkey. India’s peak tariffs on alcoholic beverages 150 percent. Motor cycles 50 percent. On the other hand, the US peak import duty is on tobacco (350 percent) peanuts (16.4 percent) etc.,

The US appears not keen on a Free Trade Agreement (FTA) as proposed by India. According to a study by FICCI and Wazir Advisors, the FTA will majority improve its share in US’ as apparel imports. From a value of 5.8 percent, it could increase to as high as 20 percent by 2025. India’s share in US imports of textiles will also increase substantially in segments of yarns and fabrics

The current global apparel market is worth $1.7 trillion as it constitutes two percent of GDP. EU-28 and China are the largest apparel markets with a combined share of about 54 percent. The global apparel market is expected to touch $2.6 trillion by 2025 with a projected rate of 4 percent. The major growth drivers of the global market will be the developing countries mainly China and India, both growing in double digits. China will become the biggest apparel market, adding more than $378 bn in market size by 2025.

These two countries with a large and growing demand will lead to a combine addition of around $500 bn in the global apparel market by 2025. The combined apparel market size of Chine and India that is $795 bn is expected to exceed the combined size of the EU and the US that is $775 bn by 2025.

In the US our textiles products attract duties ranging from 13 percent to 32 percent though the average tariffs range between 15 percent and 16 percent.

Trade experts and former negotiators explain that every WTO member maintains high tariffs on certain products to protect farmers and to promote manufacturing. India is no different, reforming to Korea’s over 800 percent duty on some products such as sweet potato and some cereals.

Indian officials refer to the “World Tariff Profiles 2018” which lists some of the highest tariffs by countries, where India at 150 percent is eclipsed by Japan at 736 percent, South Korea at 807 percent and the US at 350 percent. The trade weighted average of MFN applied tariff for India at 7.6 percent is moderate compared to Korea and Brazil, among others Officials point to India’s development imperatives, the importance of balancing imports with its own manufacturing capacity.

As it’s known, EU and US are the largest markets for textiles and apparel with a share of 36 percent and 14 percent respectively. On the supply side, China is the largest supplier of these products in the world with a dominating share of 40 percent. It is distantly followed by countries like India, Italy and Germany with an approximate share of 5 percent in the global textiles and apparel exports.

The FICCI – Wazir Advisors further notes that the textiles industry has witnessed major shift in the last three decades in terms of production till the 1980’s, production of textiles and apparel was centered in the US and EU. But over a period of time production of these items got shifted majorly to Asian Countries