Sparrow Group, a high-value clothing manufacturer exporting primarily to the USA and Europe, faced significant buyer pressure just a week ago due to concerns over Bangladesh’s questionable human rights situation, widespread student protests, and violence. However, this week, the atmosphere has changed, and Managing Director Shovon Islam is now busy managing buyer relations and ramping up production with overtime.

Sparrow Group, a high-value clothing manufacturer exporting primarily to the USA and Europe, faced significant buyer pressure just a week ago due to concerns over Bangladesh’s questionable human rights situation, widespread student protests, and violence. However, this week, the atmosphere has changed, and Managing Director Shovon Islam is now busy managing buyer relations and ramping up production with overtime.

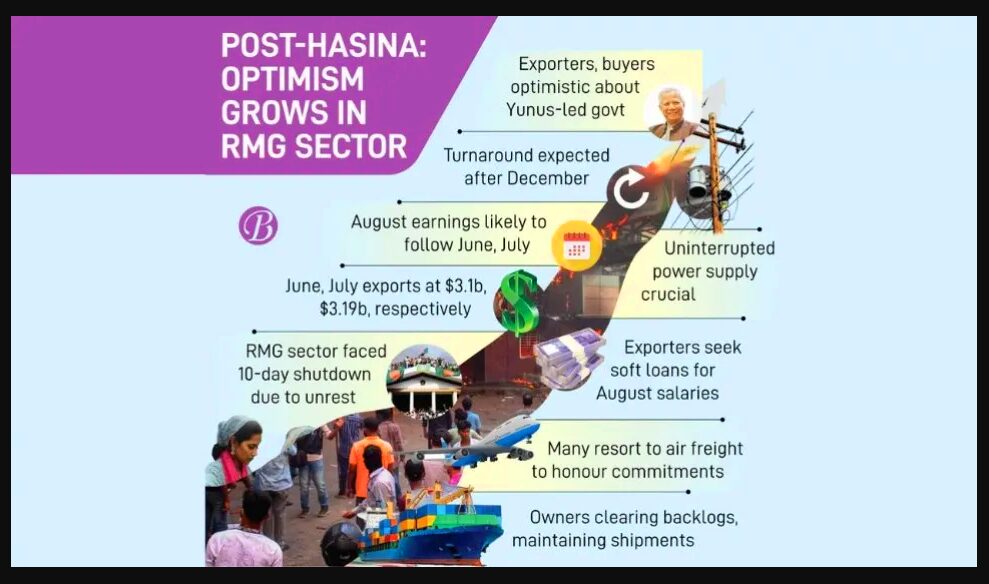

Speaking with Shovon Islam said, “Many buyers were considering shifting their orders away from Bangladesh, even in the first week of the uprising. But now, they are satisfied with the current situation.” “Interim government Chief Advisor Professor Muhammad Yunus is a globally respected leader, particularly in the Western community. Western buyers believe Yunus will be able to ensure stability in Bangladesh, allowing them to do business with us without fear,” he added.

Since the end of last year, Bangladesh has experienced ongoing violence, leading to multiple factory shutdowns. During the recent student quota reform movement and mass uprising, readymade garment factories were closed for at least 10 days in July and August.

According to the National Board of Revenue (NBR), Bangladesh recorded $3.1 billion in export earnings in June and $3.19 billion in July from clothing exports. Exporters expect August earnings to be similar to those of July.

Shovon, also a Director of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said, “Our export volumes will be sluggish over the next three months as we received fewer orders in the past two months. However, we hope that from the first quarter of next year, Bangladesh’s RMG sector will see a big jump in orders.”

BGMEA’s push for economic recovery

Since September last year, Bangladesh has been plagued by regular violence, including worker and political unrest, a controversial “dummy” election, and a crackdown on the opposition by the ousted prime minister Sheikh Hasina. These events dominated global headlines. As a result, Western buyers reduced their orders, severely impacting the economy, which was already grappling with a forex reserve shortage.

Amid this turmoil, Bangladesh saw widespread student protests starting from July 1, escalating into violence on July 15 when the Awami League, along with its affiliates and law enforcement, attacked protesting students. Lethal weapons were used against unarmed demonstrators, resulting in at least 650 casualties, according to the UN Human Rights Council.

The protests eventually evolved into a demand for the end of the authoritarian Sheikh Hasina regime, leading to her resignation and flight to India on August 5. Professor Yunus subsequently took charge as the interim government’s chief advisor.

Although law and order state in the country was critical in the first week following the August 5 revolution, the situation is now almost under control, and the interim government is working to establish greater stability.

TEAM Group Managing Director Abdullah Hil Rakib said, “Currently, almost all factories are operating at full capacity. Due to the recent revolution, we lost approximately 10 to 13 per cent of work orders. However, we are dealing with a significant backlog as production was halted for at least 10 days. “On Sunday, I had to confirm an air shipment to ensure timely delivery, despite incurring a financial loss of $1,50,000,” he added.

What exporters are doing?

Bangladesh’s economy, particularly in terms of private sector employment and foreign currency earnings, is heavily reliant on the apparel sector. This industry, which employs around 40 million people, contributes approximately 84 per cent of the country’s export earnings. To recover from the recent challenges, exporters, particularly through the sector’s apex body BGMEA, are taking action on multiple fronts. Exporters have identified their key challenges as paying workers, ensuring on-time delivery, maintaining buyer confidence, and securing uninterrupted power and energy supplies.

A group of BGMEA leaders has already met with the chief advisor, placing demands that include a soft loan to cover workers’ August salaries and an uninterrupted power supply. According to business leaders, Muhammad Yunus assured them that he and his administration would do everything possible to revive the economy and business. In addition, exporters are maintaining regular communication with buyers and brands to secure more orders.

TAD Group Managing Director Ashikur Rahman Tuhin said, “We have yet to hear of any buyers cancelling orders. Our key challenge now is to clear backlogs and ensure on-time delivery, which will help restore buyer confidence. “To achieve this, we need an uninterrupted power supply, and we trust the new government will address this.”

Sparrow Group’s Managing Director Shovon Islam added, “Professor Yunus is well-regarded in Western communities, and policymakers in these regions are looking to reduce their dependency on China. If Bangladesh can ensure stability and a reliable power supply, a significant volume of orders could shift from China to Bangladesh.”