The Central Government’s decision on GST in respect of the textiles and clothing sector (T and C) is on expected lines. By and large, the industry’s pleas for a lower rate of GST have been accepted. Not with standing this, two problem areas have been flagged off for the government’s consideration one is job work and second is GST on manmade fibres (MMF) and yarn. What is encouraging is the statement of Union Finance Minister Arun Jaitley that he is giving three months’ time to see the operation of GST, after which he would examine various demands raised by Southern India Mills Association (SIMA) and other textile bodies.

While the GST on job work up to fabric stage has been cut from 18 per cent to 5 per cent the reduction has not been extended to apparel or garment in the textile value chain. As per the government’s interpretation only services classified as job work in relation to yarn and fabrics of textiles are eligible for the reduced rate of 5 per cent. On the other hand, the industry contends that job work is a manufacturing process and, hence, should be charged at the reduced rate.

In textile clusters like Tirupur, a host of operations such as garment printing, embroidery, garment washing, ironing and packing are carried out by micro units on a job work basis. Some of these processes such as checking, ironing and button fixing are actually carried out by people who take their work to their home for job work.

As for the MMF segment, GST is proposed to be charged at 18 per cent on yarn and 5 per cent on fabrics. Tirupur Exporters Association President Raja Shanmugam wants the rate on yarn to be pared down to 12 per cent, if not up to 5 per cent. The customs duty on MMF also needs to be reviewed and reduced if not abolished to enable the textile sector to use more MMF and reduce dependence on cotton, a natural fibre.

Currently, India he says is losing ground in the global market in respect of MMF based items. This is because the ratio of cotton and synthetic usage is 70:30. It is the reverse globally. The 18 per cent GST on yarn makes the MMF-based products uncompetitive in the global market. Domestically, smaller MMF units will be badly hit.

Many a Tirupur exporter apprehends that job working units in the city will be badly affected as several owners of these units which operate out of homes and small dwellings employ family members and relatives. They are in a “dilemma” at the moment. Moreover many owners of job working units lack formal education and will have to employ a person for filing returns online. The working capital of micro, small and medium enterprises would be impacted as they would have to pay GST up front and later recover the same from the principal. Coming to MMF, yarn and fabric units will find it hard to recover the GST paid as the mechanism for availing of tax credit is available only partially says, Sakthivel, TEA, Executive Secretary.

Customs and Excise duties that apply to MMFs are a major factor in determining the price structure, with no revision in 2017 – 2018 Budget. The customs duty stands at 5 per cent. In addition, there is a 4 per cent special additional duty and an excise duty equivalent to 12.5 per cent. This brings the total duty incidence to 22 per cent. The MMF producers believe that import of fibres will be cheaper than indigenous ones even after taking into account costs involved in freight, insurance customs and countervailing duties. But with antidumping duties on raw materials to manufacture fibres, imported prices will be higher than domestic ones. This would significantly benefit MMF producers because of import parity. This means domestic prices are linked to imported prices. Local prices will be almost the same as imported ones enabling them to earn a higher benefit.

Our current reputation in global market is basically only as an efficient supplier of fibre yarn and filament fabrics. Our presence in the final products of garments and made-ups based on MMF is limited and extra efforts are needed to market them. Obviously, the government’s export incentives for these segments should be more liberal. Globally, India ranks second in man-made filament yarn production. It has 12 per cent share of global production of cellulose fibres and filaments and 7 per cent of global capacity.

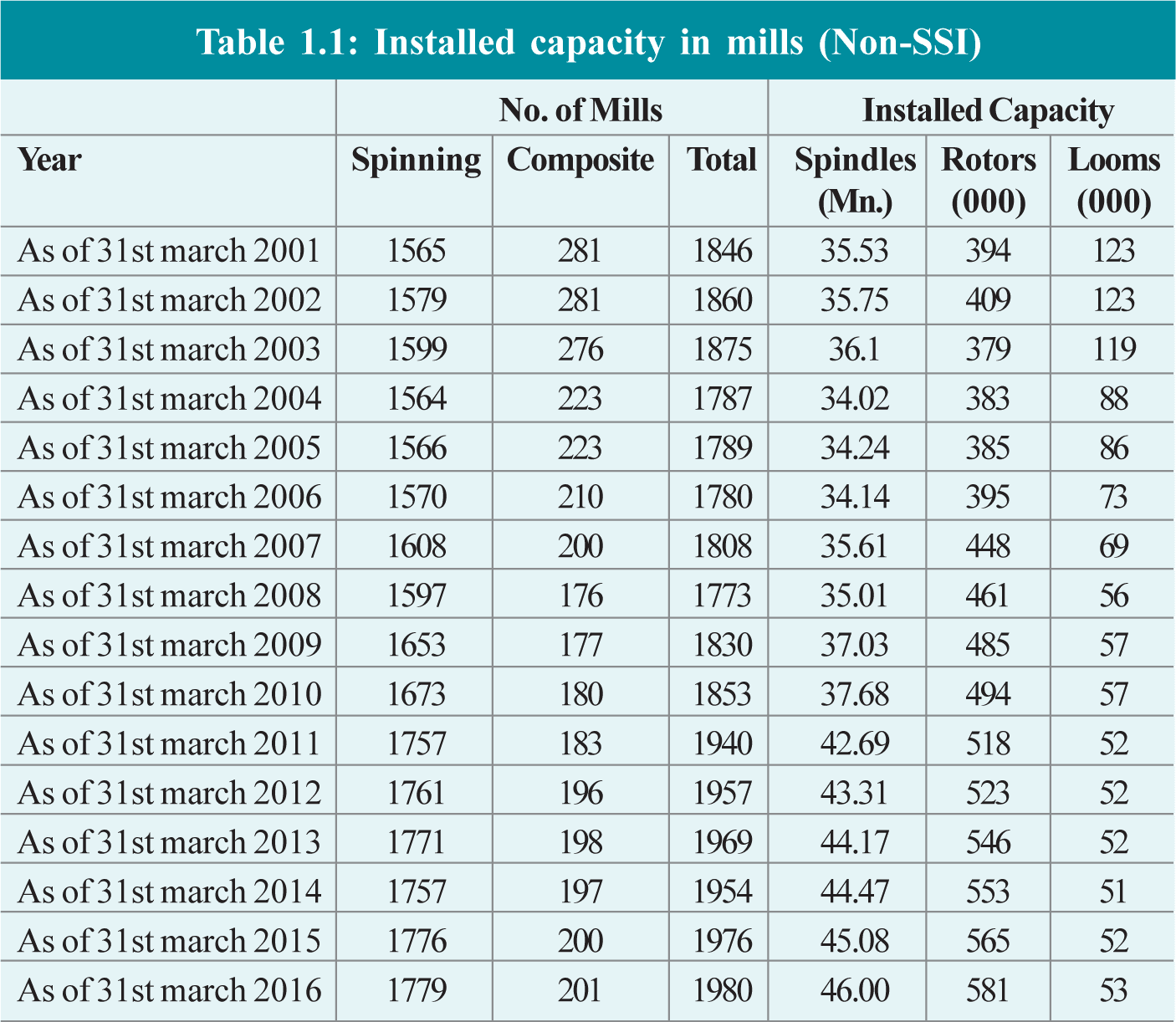

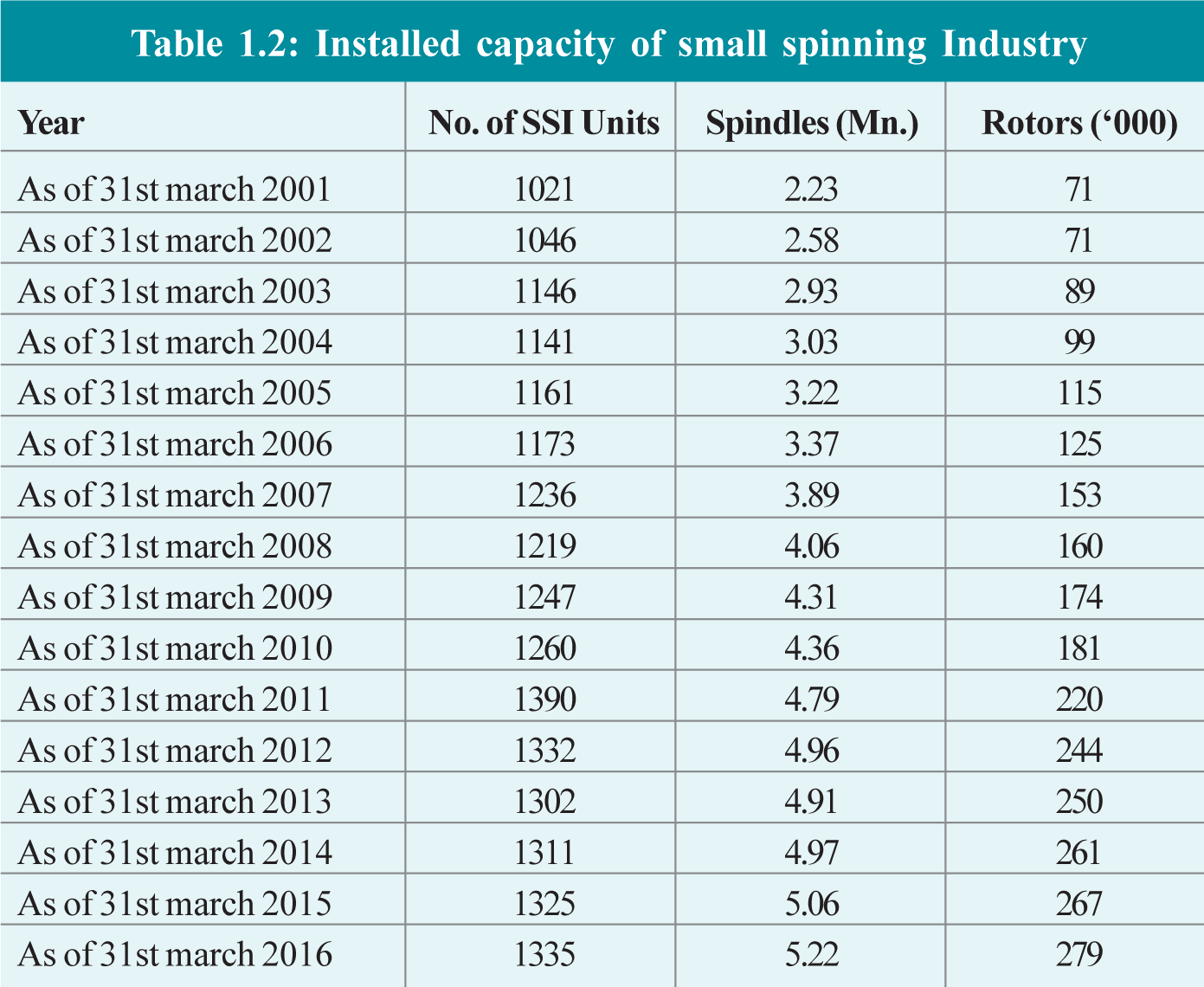

Installed capacity and production of viscose staple fibre is much higher than domestic consumption. This means increased availability for exports. Domestic consumption is 75 per cent of production and the rest is exported. But opposite is the case for viscose filament yarn. And import of viscose filament yarn is significantly higher than domestic consumption. The end of the quota regime meant an increase in fresh investment in the textile sector. The pace of investment needs to be stepped up.

Rising input costs are a major factor affecting exports worldwide. With India enjoying the advantage of its own source of raw materials, this needs to be leveraged to gain a competitive edge over other countries. Moreover, exports of cotton and cotton yarn need to be regulated in a manner that protects the domestic industry from major fluctuations in raw material prices. There is potential to increase exports by capacity build-up in the sector. For this, improving the compliance level in the factories by introduction of common code for the apparel sector is necessary.