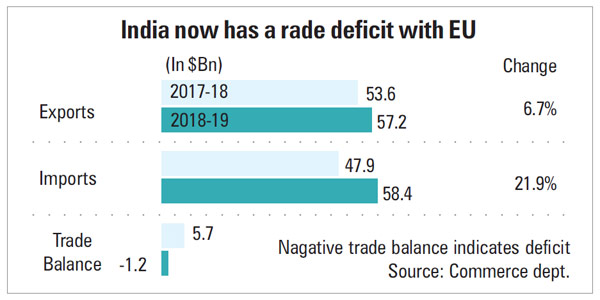

After the sweeping election victory of British Prime Minister Boris Johnson, what comes uppermost in the minds of those in authority in New Delhi is the future economic and trade relations between the two countries. Yes, there is a possibility of New Delhi forging a trade agreement with the UK post BREXIT. The legislation introduced by Johnson in Parliament for the purpose got cleared easily, setting the UK on course to leave the European Union (EU) on January 31, 2020, as planned. Beginning February 1, EU and British officials will engage in intense regotiations on the future trade relations between the divorcing partners. There is a transition period until the end of 2020 in which the UK will continue to follow the EU rules. Johnson is unlikely to seek an extension. The British Government will have to decide by July 1, if it wants to postpone the December 21, 2020 deadline. Against this background, New Delhi should first step up efforts to conclude the proposed long- pending Broad-Based Trade and Investment Agreement (BITA) with the EU. It is a must to fend off competition and be on par with Least Developed Countries (LDCs) and Pakistan in respect of duty free access of textiles and garments in the EU. Simultaneously, EUs specialised textiles products will also be able to enter the Indian market duty free.

It is to be noted that a trade deal with the UK bristles with several problems. There are reports that Ireland and Scotland may go out of the UK and stay with the EU. In that event, New Delhi will have to sign a third agreement with these two nations. Another serious issue is whether the UK will follow the same policy of the EU with regard to LDCs. If it does so, it is good news for India which can hope to enter the EU market for duty free entry of cotton textiles. Out of the total cotton textiles imported into the EU, the UK alone accounts for 61 percent. Again nearly 25 percent of India’s textiles and clothing exports are destined to the UK. Therefore, after BREXIT, the UK offers a huge opportunity for export of cotton textile and any prefirenteal arrangement with the UK could help India.

Negotiations between India and the 28 member EU have been on since 2007 but have got stalled on issues such as import of automobiles and spirits intellactual property rights etc. However, the latest reports suggest that New Delhi has indicated “flexbility” in reducing import duties on wines and spirits and automobiles as part of BITA. These were the two contintious issues where India was unwilling to lower the import duties resulting in a stalemate. Efforts have started with the India flagging the issue with German Chancellor Angela Merkal and the Commerce Minister Piyush Goyal following it up with the EU Trade Commissioner, Phil Hogon, recently. The possibility of the BITA going through has become bright now. Pakistan receives duty free treatment under EU’s GSP plus scheme. India does not receive such a dispensation, but gets a 20 percent deduction on the duties applied by the EU on textiles products. With the deduction, ready made garments get charged at 9.6 percent against 12 percent levied before. Bangladesh also receives duty free access in the EU. The GSP benefits are also made available to Turkey (an EU member) which also enjoys logistic advantage due to proximity to the EU. Therefore, the EU GSP policy is discriminatory.

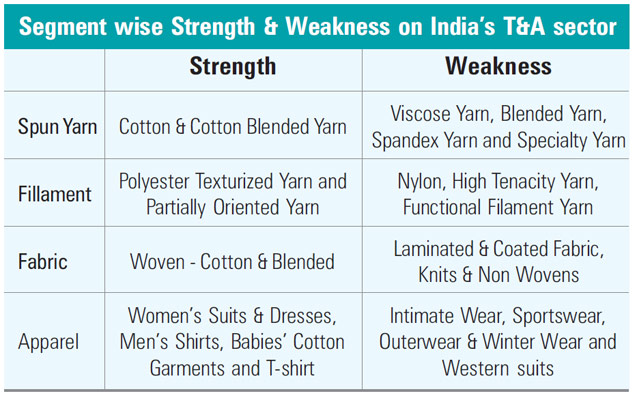

Indian fabrics to the EU attract an 8 percent duty, while yarn exports are charged a 4 percent duty. In the US, India’s apparel exports attract an average duty of 10.2 percent while nil rates are applied on imports from Bangledesh and Ethiopia in the EU and zero duty on imports from Ethiopia in the US. As reported in these columns earlier, the selective preferential duty free access has resulted in India losing out 37 fabrics items to Pakistan on account of zero duty access to that country by the EU. In China, Indian fabrics are charged at 8.5 percent duty, while no duty is levied on the same item entering from Pakistan. New Delhi can gain by negotiations for tariff concessions with China for grey fabrics under the Regional Comprehensive Economic Partnership Agreement (RCEP) as Pakistan has a 80 percent share of the market and India has two percent share. It is known that Turkey has a well-established textiles and apparel industry. It is also a good market for fabrics, especially the fine and denim type from India, Istanbal, however has levied, as a protectionist measure, additional duties on Indian fabrics. With this, the minimum duty stands at 1.25 dollar per kg and the maximum at $4.25 per kg tariff.

Indian fabrics to the EU attract an 8 percent duty, while yarn exports are charged a 4 percent duty. In the US, India’s apparel exports attract an average duty of 10.2 percent while nil rates are applied on imports from Bangledesh and Ethiopia in the EU and zero duty on imports from Ethiopia in the US. As reported in these columns earlier, the selective preferential duty free access has resulted in India losing out 37 fabrics items to Pakistan on account of zero duty access to that country by the EU. In China, Indian fabrics are charged at 8.5 percent duty, while no duty is levied on the same item entering from Pakistan. New Delhi can gain by negotiations for tariff concessions with China for grey fabrics under the Regional Comprehensive Economic Partnership Agreement (RCEP) as Pakistan has a 80 percent share of the market and India has two percent share. It is known that Turkey has a well-established textiles and apparel industry. It is also a good market for fabrics, especially the fine and denim type from India, Istanbal, however has levied, as a protectionist measure, additional duties on Indian fabrics. With this, the minimum duty stands at 1.25 dollar per kg and the maximum at $4.25 per kg tariff.

Apart from LDCs, India also will have to compete with countries having regional trade agreements with the US such as Honduras, Dominican Republic and others which enjoy duty free access in the US and the EU. The result India has to content with high duties. Then, there are small free Trade Agreements (FTAs) being signed among WTO members. This has limited trade opportunities outside WTO. A new bilateral trade deal between EU and South Africa is already in place. The US also had deals in the works with South Korea and Combodia, but they have been stalled in the congress. India is one of the largest textiles manufacturing countries after China. It holds enormous potential to converts itself into a textiles manufacturing hub for the entire world. Increasing penetration of organised retail and disposable income on the rise make the future of the Indian textiles industry look promising. However, the industry at present also facing several other issues like non-supportive government policies, tax structure, rising interest rates, increasing labour wages and lack of skilled manpower, which are detrimental to the industry’s growth on the export front too, the sector is facing high trade barriers compared to other competing countries such as Bangladesh, Vietnam and Pakistan in key markets such as the US and the EU.

The government has set a $350 bn target for the textiles and apparel market. To achieve this, outgoing CITI Chairman, Sanjoy K Jain suggests that there is need for the quality, innovation, technology and lead time of the manufacturers to be aligned in a manner to bring growth and stability to the industry. Recently, China has shifted its focus from exports to the domestic market. This has opened space for India to take up its share and strengthern its position in the global textiles chain. For this, the industry requires economies of scale in production. Countries ranging from China to Bangladesh have developed large production units, whereas in India, the industry is still dominated by smaller units, which lack economies of scale. This under scores the urgent need for supportive measures from both the Central and State Governments. Jain wants the government to initiate urgent measures to safeguard the interests of the textiles and clothing sector. First a one year moratorium on loan repayment to revive it from the current crisis on a fast track mode to enable it to achieve its actial potential and advise banks to not coerce companies by adhoc increase in interest rates without any reason. Second, grant of refund of State, Central taxes and Levies (ROSCTL) to the yarn and fabric segments to help the textiles industry boost its export competitiveness in the global market.

The government has set a $350 bn target for the textiles and apparel market. To achieve this, outgoing CITI Chairman, Sanjoy K Jain suggests that there is need for the quality, innovation, technology and lead time of the manufacturers to be aligned in a manner to bring growth and stability to the industry. Recently, China has shifted its focus from exports to the domestic market. This has opened space for India to take up its share and strengthern its position in the global textiles chain. For this, the industry requires economies of scale in production. Countries ranging from China to Bangladesh have developed large production units, whereas in India, the industry is still dominated by smaller units, which lack economies of scale. This under scores the urgent need for supportive measures from both the Central and State Governments. Jain wants the government to initiate urgent measures to safeguard the interests of the textiles and clothing sector. First a one year moratorium on loan repayment to revive it from the current crisis on a fast track mode to enable it to achieve its actial potential and advise banks to not coerce companies by adhoc increase in interest rates without any reason. Second, grant of refund of State, Central taxes and Levies (ROSCTL) to the yarn and fabric segments to help the textiles industry boost its export competitiveness in the global market.

Third, interest rates should be made available at internationally competitive prices. If that is not possible, three percent. Interest Equalisation Scheme (IES) may be given to cotton yarn exports. Fourth, power should be made available to the spinning industry at internationally competitive prices Fifth negotiations should be started with China to get duty free access to cotton textiles as it has been giving to Vietnam, Pakistan, indonesia and Cambodia, Sixth, abundent raw materials should be made available to the industry at internationally compettive prices. Finally, the government must take steps to raise the import duty on manmade fibre spun yarn, from 5 percent to 10 percent.