Garment prices may burn a hole in your pocket for this Deepavali in the wake of an increase in production cost incurred by the Tirupur textile units. Apparel manufacturers claimed to have increased the price of garments by around 40 percent to meet the increasing production cost and to offset losses. They attributed a steep increase in cost of garments to a sharp hike in yarn prices.

Garment prices may burn a hole in your pocket for this Deepavali in the wake of an increase in production cost incurred by the Tirupur textile units. Apparel manufacturers claimed to have increased the price of garments by around 40 percent to meet the increasing production cost and to offset losses. They attributed a steep increase in cost of garments to a sharp hike in yarn prices.

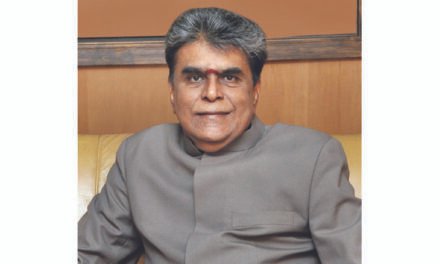

“For the textile units, increasing the cost of garments is the only way out to stay afloat in this competitive industry. The crowd on the streets doesn’t reflect the real scenario and isn’t translating into good business. Even after recovering from COVID-19, buying tends to remain limited as a person, who gets a handful of extra garments now opts to go with just a single piece as the amount spent on clothes also have reduced drastically. Unfortunately, increase in prices of cotton garments has led to 60 percent of people moving over to cheaper alternatives like polyester and rayon fabrics, which have now flooded the market,” said MP Muthurathinam, President of Tirupur Exporters and Manufacturers Association (TEAMA)

A spokesperson with South Indian Hosiery Manufacturers Association (SIHMA) said that domestic orders have reduced by 50 percent and textile units, which ran for three to four shifts are now operating only single shifts. Already, SIHMA has announced an increase in the price of vests and briefs by 15 percent in its selling cost.

With a majority of manufacturing units staring at no work, the workers, mostly guest workers from North India have begun to leave Tirupur much earlier from the first week of October.

“There is no work for 70 percent of workers. In the previous years, during such peak business season, workers used to toil day and night till the festival day of Deepavali to finish orders. In a rather different scenario, this year the migrant workers have started going home long back since ‘Ayudha pooja’ due to lack of work. Even mills are running for just two days a week,” said Muthurathinam.

Production has already been stopped in several textile manufacturing units. “Apparently trains leaving Tirupur to north India remain crowded and firms are giving forced leave in advance,” said S Guhan, another garment manufacturer.

The knitwear hub provides employment to seven lakh workers directly and another four lakh workers indirectly in the allied sector.

Drastic 70 pc drop in exports due to Covid, Ukraine war: Multiple factors have resulted in knitwear export orders dropping drastically after showing some signs of revival from the impact of COVID-19. Exporters say that orders have dropped drastically by 70 per cent due to the twin impact of COVID-19 and Russia-Ukraine war, which has had a cascading effect on the purchasing power of the European consumers. The US market has also been hit due to high inflation.

However, the exporters are hopeful that business will revive in the coming days. “We expect a boom in the textile sector after Deepavali due to bountiful cotton production and drop in yarn prices. Then we will be able to match the price in the international market,” said KM Subramanian, President of Tirupur Exporters Association.

Garment exporters said that after COVID-19 impact, the sector began to look up, but turned dull following the Russia-Ukraine war as the purchasing power of people has come down in Europe.

“Of the Rs 33,000 cr worth orders executed in the last financial year, the textile sector now receives just 60 per cent of orders. Following a drop in yarn prices, the textile sector has now come forth to reduce garment prices by 20 percent, which will also reflect in the coming season,” he added.

MP Muthurathinam, President of Tirupur Exporters and Manufacturers Association (TEAMA) said, “Several orders slipped away as the rise in yarn prices came exactly when the peak business season for this festival season commenced. The current drop in prices of yarn to Rs 72,000 per candy is of no use as export orders have come to a standstill. Also doubt persists, whether the yarns prices will remain steady and international buyers have started to bargain for low rates, much less than the production cost of garments due to this drop in yarn prices.”

Similarly, the Indian domestic market remains dull due to heavy rains in some northern states resulting in stagnation of goods. “Almost 80 per cent of garments have stagnated in the domestic market, while the buyers have asked not to deliver and wait until the situation turns normal,’’ he added.

“When our competing countries are having benefits like free trade agreements, least developed country status, generalized system of preferences plus (GSP+) coupled with wage advantage, we do not have any such benefits and therefore undergoes less competitiveness in the global market,” said Raja M Shanmugham, an garment exporter.

Tirupur knitwear exports contribute 13 per cent of total Tamil Nadu exports with a value of Rs 33,525 cr. The domestic knitwear sale is about Rs 27,000 cr.